简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

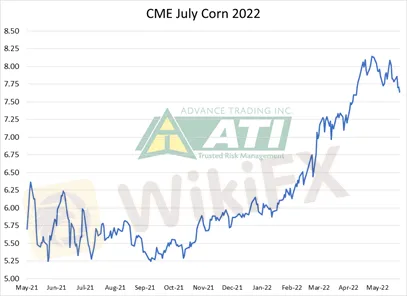

WIKIFX REPORT: Look at how the market has changed since harvest

Abstract:The decision to keep harvesting or cease harvesting has a direct impact on how much fresh produce is available and how much is remaining in the market. The unofficial start of summer is commonly referred to as Memorial Day weekend. It's also when maize price volatility tends to spike as the important northern hemisphere growing season approaches.

The decision to continue the harvest, or stop harvesting, directly influences how much fresh produce is available in the marketplace, and how much is left. Memorial Day weekend is often referred to as the unofficial start of summer. Its also when corn price volatility often increases amid uncertainty surrounding the critical northern hemisphere growing season.

Of course It‘s hard to believe that at the start of the 2021/22 marketing year in September, July corn futures were trading just above $5.00. The fundamentals have changed since then. The biggest change has been Russia’s invasion of Ukraine in late-February. That disrupted corn exports from Ukraine and helped support increased U.S. corn exports this spring. Since early February, July corn futures have rallied more than $1.50.

December 2022 corn futures on Friday closed at $7.30, which is the highest price ever for December corn at this time of year. Similarly, November 2022 soybean futures on Friday closed at $15.44, which is the highest price ever for November soybeans at this time of year. In the context of developing and implementing a risk management strategy, what have we learned the past few months that can help you to be successful with your marketing this summer?

Initially, and most importantly, it confirms again that price prediction is impossible. Nine months ago, very few were talking about an invasion of Ukraine by Russia and the possible market impact. And while the rally has met the need to offset the rising cost of inputs, there is no guarantee it will stay at these levels, or even, to go higher. As a marketer, you must take a disciplined approach to your business that does not involve price prediction.

Additionally, change in market trend happens and often at very fast speed. This is probably truer today than its ever been, given the geopolitical uncertainty in the world at the moment. Case in point: Crude oil is sharply higher today as European leaders take a hard line against Russian oil. The EU plans to ban 90% of Russian oil by the end of 2022. The funds make an impact on markets each day when they trade the headlines. As the market moves in a response to geopolitical activity, anything is possible, and nothing is certain.

And lastly, a consistent approach to marketing helps reduce the emotions associated with selling the grain. In these volatile markets, emotions can gain ground—and understandably so as it is your livelihood. But it is imperative you stay the course in your marketing plan. The purpose of the plan is to take advantage of higher prices and to prepare for a price drop. With these key elements in place, you can put the emotions of marketing to rest and block out the noise of market sensationalists and the worry they cause from your mind.

Just as the past few months have contained some unexpected developments, more surprises—bearish and bullish—are likely to be seen before the 2022 corn crop is ready to be harvested this fall. Keys to successful marketing in this type of environment include preparation and execution of a flexible and disciplined risk management strategy. As always, your Advance Trading advisor is ready to assist in developing a marketing program to defend your balance sheet.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

StoneX Financial Secures General Clearing Membership with ECC

StoneX Group Inc. has announced that its subsidiary, StoneX Financial Limited, has been granted General Clearing Member (GCM) status by European Commodity Clearing AG (ECC).

easyMarkets Kicks Off the Start of Its Trade with the Champions Competition

easyMarkets has launched its Trade with the Champions competition. The event will run from 2 December 2024 to 15 January 2025. It is open to both new and existing traders, offering them a chance to compete and win prizes.

MAS Imposes $2.4M Fine on JPMorgan Chase for Misconduct

JPMorgan Chase is fined $2.4 million by MAS for overcharging clients on OTC bond trades, misrepresenting spreads, and unethical actions by relationship managers.

CONSOB Extends Crackdown on Unauthorised Financial Websites

Italy’s Companies and Exchange Commission (CONSOB) has intensified its efforts to combat illegal financial activities, recently ordering the blocking of four additional websites providing unauthorised financial services

WikiFX Broker

Latest News

Ontario launches major US ad campaign amid Trump's tariff threat

Capital.com Collaborated with Amazon in the UAE

ActivTrades Gains Regulatory License in Mauritius

Ripple’s RLUSD Stablecoin Expected to Launch in NY by Dec. 4

Apple Pay, Google Pay Eyeing Launch in the Philippines

easyMarkets Kicks Off the Start of Its Trade with the Champions Competition

Businessman Pleads Guilty to $5.9M Ponzi Scheme

Philippines Warns Public of Get-Rich-Quick Scams This Christmas

Know Ins & Outs of Prop Trading Firms

Malaysian Loses RM2.6 Million to Online Investment Scam

Currency Calculator