简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

WikiFX Review: Can this broker enhance your trading results?

Abstract: BDSWISS, also called BDS Markets, is an online broker that offers leading financial services to more than one million clients all over the world. But is this broker really trustworthy? Can we enhance our trading results by investing in this broker? WikiFX made a comprehension review on this broker to help you better understand the truth, we will analyze the reliability of this broker from specific information, regulation, exposure, etc. Let’s get into it.

If you want to know whether BDSWISS is a reliable forex broker or not, please continue to read.

In this article

WikiFX provides inquiry services in the forex field.

WikiFX evaluates the reliability of BDSWISS based on the facts.

What is WikiFX?

| WikiFX is an authoritative global inquiry platform providing basic information inquiry and regulatory license inquiry. |

| WikiFX is able to evaluate the safety and reliability of more than 34,000 global forex brokers. |

| WikiFX gives you a huge advantage while seeking the best forex brokers. For more information, such as the review and exposure of brokers, please visit our website (https://www.WikiFX.com/en) |

To explore whether BDSWISS is a scammer or not, we evaluated BDSWISS from different aspects, such as regulatory status, exposure, etc.

Table of Contents

1. Evaluate the reliability of BDSWISS based on its general information and regulatory status

To understand BDSWISS better, we explore BDSWISS by analyzing three main perspectives:

A. General Info of BDSWISS

B. Regulatory Status

C. Fund Security

A. General Info of BDSWISS

BDSWISS s general info has been shown below:

(source: WikiFX)

About BDSWISS

BDSWISS, also called BDS Markets or BDSWiss, is an online broker that offers leading financial services to more than one million clients all over the world. BDSwiss as a brand was established back in 2012 and has since then been providing award-winning conditions, world-leading platforms, competitive pricing and optimal execution on more than 1000 underlying CFD instruments. as of Jun 30th 2020, it has more than 1.5 million registered accounts. The physical address of this broker is 6th Floor, Nexteracom Building, Ebene, Mauritius.

Market Instruments

In BDSWISS, traders can trade 50 major currency pairs, minor currency pairs, and minor currency pairs. The most popular commodities include crude oil, natural gas, and noble metals against major currencies, hundreds of share CFDs from the world's largest exchanges, and the world's leading indices products, all popular digital currency products, including Bitcoin and Litecoin, Ripple, and Ethereum CFD and ETF trading.

Leverage

In terms of trading leverage, European clients can now use only a maximum leverage level 1:30 for Forex instruments, and the global BDSwiss traders may be still entitled for a higher range of up to 1:500

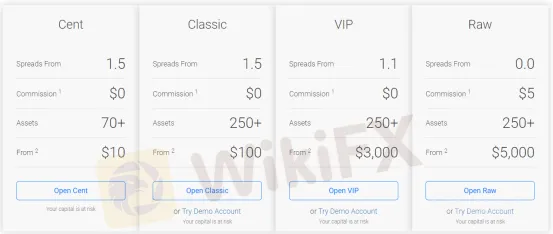

Account Types& Minimum Deposit

BDS Markets provides clients with four different types of accounts. They are Cent account, Classic account, VIP account and RAW account. The minimum deposit for Cent account is only $10. The minimum deposit for classic account is $100. The minimum deposit for VIP account is $3000. The minimum deposit for RAW account is $5000.

(source: BDS Markets website)

Spreads & Commissions

BDSwiss Classic and VIP account fees are all included in the spread spreads and commissions charged when conducting trade and vary according to the account type you select. Classis spread are starting from 1.5 pips and VIP feature lower conditions with a spread from 1.1 pip.

Trading Platform

BDS Markets uses MT4 and MT5 as its main trading platforms. Besides, this broker also offers clients BDSwiss Mobile App and BDSwiss WebTrader.

(source : WikiFX)

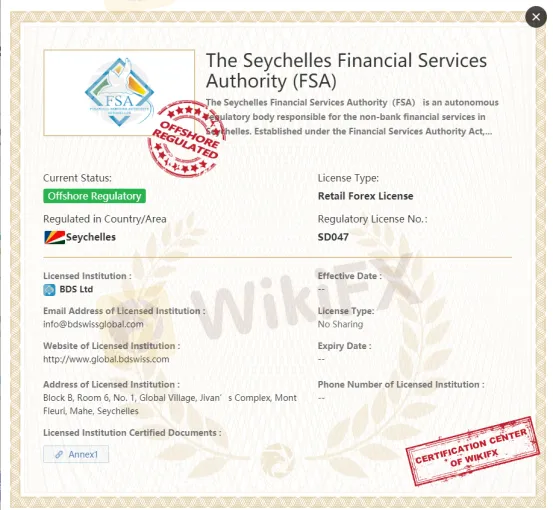

B. Regulatory Status

The legitimate license of BDS Markets

BDSWiss is a regulated broker. It is regulated by the Financial Services Commission of Mauritius (FSC) under License Number: C116016172. It is also regulated by CySEC with license number: 199/13 and FSA with license number: SD047. However, it exceeds the business scope regulated by United States NFA(license number: 0486419).

(source : WikiFX)

C. Fund Security

As a broker regulated by CySEC, BDSWISS needs to keep the clients funds on segregated bank accounts. Account segregation is imperative since it allows traders to have access to their funds all the time. Even if the broker is bankrupt, traders will still be capable of getting their money back. Unfortunately, this broker seems not to have a category to emphasize the fund security on its website.

2. The feedback from Twitter

To figure out whether this broker is a scam or not, we made a survey about this broker on Twitter.

Survey on Twitter:

BDSWISS seems to be taking its brand's presence on Twitter very seriously. It has many official Twitter accounts, each account focuses on one specific target market.

It is hard to find negative feedback related to this broker on Twitter.

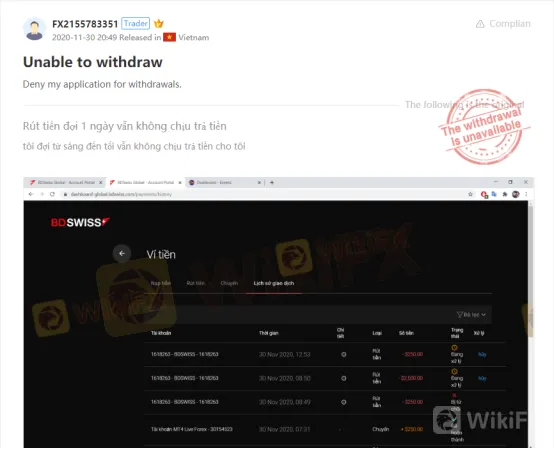

3. Exposure related to BDSWISS on WikiFX

On WikiFX, the Exposure consists of feedback from traders. A bad track record of brokers can be checked via Exposure. WikiFXs Exposure function helps you get feedback from other traders and remind you of the risks before it starts.

This trader from Vietnam can not withdraw money from BDSWISS.

4. Special survey about BDSWISS from WikiFX

A. Scoring Criteria

WikiFX gives brokers a score from 0 to 10. The higher the score is, the more reliable the broker is.

| The Scoring Criteria of Brokers on WikiFX |

| License index: reliability and value of licenses |

| Regulatory index: license regulatory strength |

| Business index: enterprise stability and operational capability |

| Software index: trading platform, instruments etc |

| Risk Management index: the degree of asset security |

BDS Markets has been given by WikiFX a good rating of 7.24 /10.

(Note: Because different regions or countries have different levels of regulatory strictness, the score of the same broker might be slightly varied in other regions or countries. For details, please consult WikiFX customer service.)

(source:WikiFX)

According to the above, it seems that BDSWISS is an excellent broker that has done a fantastic job in every category.

B. Field Investigation

To help you fully understand the broker, WikiFX also investigates the brokers by sending surveyors to the brokers physical addresses.

On WikiFX, you can visually check the physical addresses of brokers by pressing the “Survey” button.

WikiFX did make a on-site survey on BDSWISS in 2019 and successfully found their office

(source:WikiFX)

C. WikiFX Alerts

(source:WikiFX)

5. Conclusion: Can BDSWISS enhance your trading result?

It is no doubt that BDSWISS is a solid broker. WikiFX gives it a pretty decent rating. . Although it is a regulated broker, we advise you to do more research since it recently has problem of withdrawal refusal. If you want to know more information about the reliability of certain brokers, you can open our website (https://www.WikiFX.com/en). Or you can download the WikiFX APP for free through this link below (https://www.wikifx.com/en/download.html). Running well in both the Android system and the IOS system, the WikiFX APP offers you the easiest and most convenient way to seek the brokers you are curious about.

Click on BDSWISS's WikiFX page for details

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

WikiEXPO Dubai 2024 will take place soon!

2 Days Left!

Italian Regulator Warns Against 5 Websites

The Italian regulator, CONSOB has issued a warning against five websites offering unauthorized financial services. This regulatory action aims to protect the public from fraudulent activities.

WikiEXPO Dubai 2024 is coming soon

3 Days Left!

Trader Exposes Unethical Practices by STP Trading

A recent allegation against STP Trading has cast doubt on the firm's business practices, highlighting the potential risks faced by retail traders in an increasingly crowded and competitive market.

WikiFX Broker

Latest News

Hackers Charged for $11M Crypto Theft Using SIM-Swaps

Role of Central Banks in the FX Market

FCA Alerts Against Sydney FX

What Makes Cross-Border Payments Easier Than Ever?

Trader Exposes Unethical Practices by STP Trading

Bitcoin Nears $100,000: A Triumph of Optimism or a Warning Sign?

Malaysian Man Loses RM113,000 in Foreign Currency Investment Scam

Mastercard Partners with JPMorgan for B2B Cross-Border Payments

FCA Identifies Clone Firm Exploiting Admiral Markets' Credibility

Coinbase Under Scrutiny Amid Wrapped Bitcoin Delisting Controversy

Currency Calculator