简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

When is China CPI and how might it affect AUD?

Abstract:'Elevated commodity prices are set to buoy China producer inflation in March but the pass through to consumer prices is still limited,'' analysts at Westpac said in anticipation of today's data from China.

The Chinese Consumer Price Index and Producer Price Index, released by the National Bureau of Statistics of China, are due at 01:30 GMT on Monday.

Meanwhile, the economic toll that coronavirus is having will be a concern in financial markets. Shanghai has been under lockdown since 28 March. The city of 26 million people reported 1,006 confirmed infections and almost 24,000 asymptomatic cases over the previous 24 hours with the 23,107 total reported for China on April 7. Indeed, Omricon will be expected to deal a big blow to China's economy. The most recent hard numbers on Chinas economy refer to January and February which are dated given the war in Ukraine, oil prices surging as well as a new jet of covid-19 cases.

How will AUD react?

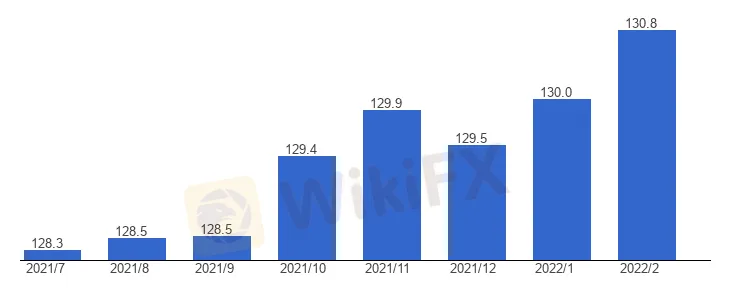

The price of AUD that trades as a proxy to Chinese economic events, would come under pressure in light of a worsening outlook for the Chinese economy. The data today, could hurt the Aussie with the risks of stagflation. Inflation in China has failed to pick up this year so far with the continually high PPI and growing raw material prices weighing on firms while the low CPI data reflects the present sluggish domestic demand. AUD/USD is already under pressure on Monday, down 0.2% with 30 minutes to go to the release of the data.

About China CPI

The Consumer Price Index is released by the National Bureau of Statistics of China. It is a measure of retail price variations within a representative basket of goods and services. The result is a comprehensive summary of the results extracted from the urban consumer price index and rural consumer price index. The purchase power of the CNY is dragged down by inflation.

The CPI is a key indicator to measure inflation and changes in purchasing trends. A substantial consumer price index increase would indicate that inflation has become a destabilizing factor in the economy, potentially prompting The Peoples Bank of China to tighten monetary policy and fiscal policy risk. Generally speaking, a high reading is seen as positive (or bullish) for the CNY, while a low reading is seen as negative (or Bearish) for the CNY.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

WikiEXPO Dubai 2024 will take place soon!

2 Days Left!

Italian Regulator Warns Against 5 Websites

The Italian regulator, CONSOB has issued a warning against five websites offering unauthorized financial services. This regulatory action aims to protect the public from fraudulent activities.

WikiEXPO Dubai 2024 is coming soon

3 Days Left!

Trader Exposes Unethical Practices by STP Trading

A recent allegation against STP Trading has cast doubt on the firm's business practices, highlighting the potential risks faced by retail traders in an increasingly crowded and competitive market.

WikiFX Broker

Latest News

Hackers Charged for $11M Crypto Theft Using SIM-Swaps

Role of Central Banks in the FX Market

FCA Alerts Against Sydney FX

What Makes Cross-Border Payments Easier Than Ever?

Trader Exposes Unethical Practices by STP Trading

Malaysian Man Loses RM113,000 in Foreign Currency Investment Scam

Bitcoin Nears $100,000: A Triumph of Optimism or a Warning Sign?

Mastercard Partners with JPMorgan for B2B Cross-Border Payments

FCA Identifies Clone Firm Exploiting Admiral Markets' Credibility

Coinbase Under Scrutiny Amid Wrapped Bitcoin Delisting Controversy

Currency Calculator