简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Can Plus500 make your money safe? WikiFX investigated the reliability of Plus500

Abstract:What does Plus500 look like? According to Plus500’s website, the Plus500 trading platform is offered by the company called Plus500SEY LTD. Plus500SEY Ltd is a Seychelles based company with its offices located in Victoria. However, as of March 7th 2022, a lot of complaints related to this broker have been received by WikiFX. Traders are unlikely to feel comfortable and safe even if Plus500 is a licensed broker. If you want to know whether Plus500 is a reliable forex broker or not, please continue to read.

In this article

WikiFX provides inquiry services in the forex field.

WikiFX evaluates the reliability of Plus500 based on the facts.

What is WikiFX?

| WikiFX is an authoritative global inquiry platform providing basic information inquiry and regulatory license inquiry. |

| WikiFX is able to evaluate the safety and reliability of more than 31,000 global forex brokers. |

| WikiFX gives you a huge advantage while seeking the best forex brokers. For more information, such as the review and exposure of brokers, please visit our website (https://www.WikiFX.com/en) |

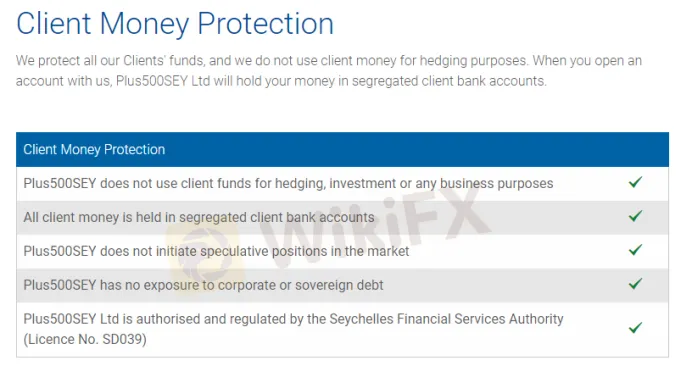

To explore whether Plus500 is a scammer or not, we evaluated Plus500 from different aspects, such as regulatory status, exposure, etc.

1. Evaluate the reliability of Plus500 based on its general information and regulatory status

To understand Plus500 better, we explore Plus500 by analyzing three main perspectives:

A. General Info of Plus500

B. Regulatory Status

C. Fund Security

A. General Info of Plus500

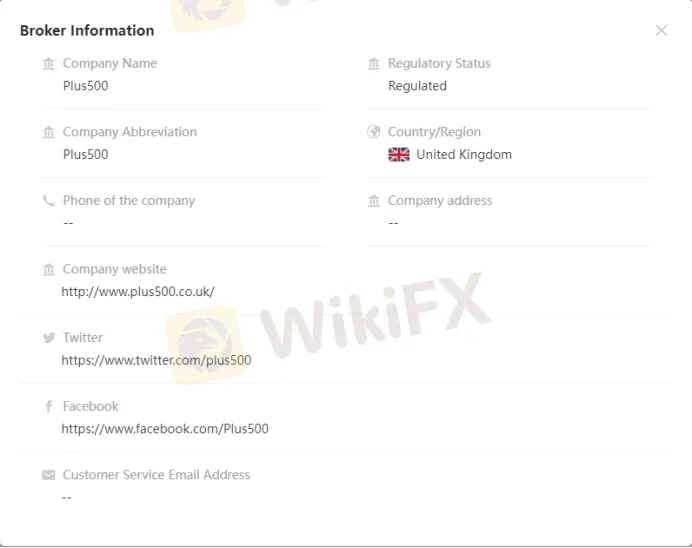

Plus500 s general info has been shown below:

(source: WikiFX)

(source: WikiFX)

Plus500 is an online foex and CFDs broker offering a large range of financial instruments, such as shares, forex, commodities, cryptocurrencies, ETFs, options and indices.

Plus500 supports six language, including English, Chinese and Spanish.

Market Instruments

Plus500 offers investors access to popular products in the global financial markets, including forex, indices, commodities, cryptocurrencies, ETFs, and more.

Plus500 Minimum Deposit

The minimum deposit required by Plus500 is $100, as there seems only one account available on the Plus 500 platform. The minimum deposit via bank transfer is $500.

Plus500 Leverage

Plus500 offers two account types, retail accounts and professional accounts. Both accounts – Retail and Pro accounts – are the same in most aspects. The main difference between them is that the retail account features lower leverage ratios compared to the Pro account. Professional clients do not have ICF rights. Professional traders can apply for the trading leverage of up to 1:300.

Spreads & Commissions

Plus500 does not require any hidden fees, and profits are built into spreads. The minimum spreads for Forex products start from 0.8 pips for EUR/USD, 0.15 pips for EUR/GBP, and 0.13 pips for GBP/USD.

Inactivity Fees

Plus500 does charge an inactivity fee. Traders who have not logged into the account for more than 3 months are subject to inactivity fee. The fee is $10 per quarter after this 3-month period has passed.

Trading Platform

Plus500 offers their proprietary in-house trading platform called WebTraders, available on all devices (Windows PCs, tablets, smartphones, web browsers). Plus500 does not offer the popular MetaTrader 4 (MT4) platform that would have added functionality and customization options.

Deposit & Withdrawal

Plus500 allows trader to fund their accounts through several payments methods, Visa, Mastercard credit & debit cards, bank transfer, and some e-wallet including Skrill and Neteller on the list of its payment options. In rare cases, users may incur commissions for transferring funds to or from the company's account. The fees are determined and charged by the user's payment issuer or bank (not by the Plus500).

Customer Support

Plus 500 platform has live online chat customer service and e-mail customer support and representatives are available 24/7. Besides, users reported that e-mail responses take up to an hour, though response times vary depending on the complexity of the issue.

(source : WikiFX)

B. Regulatory Status

The legitimate license of Plus500

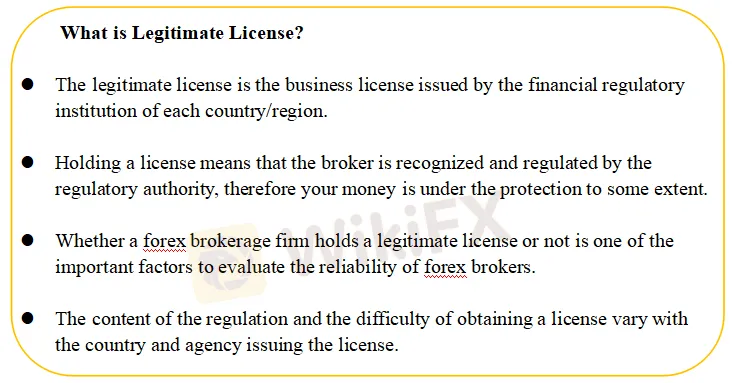

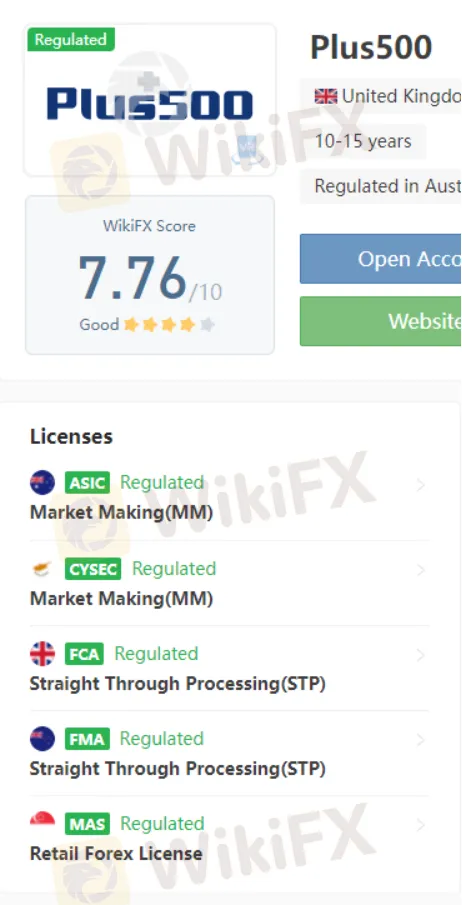

It is no doubt that Plus500 is a regulated broker. According to WikiFX, Plus500 is regulated by the following: the ASIC with license number 417727; The CySEC with license number 250/14; The FCA with license number 509909; The FMA with license number 486026; The MAS with license number: Unreleased.

(source : WikiFX)

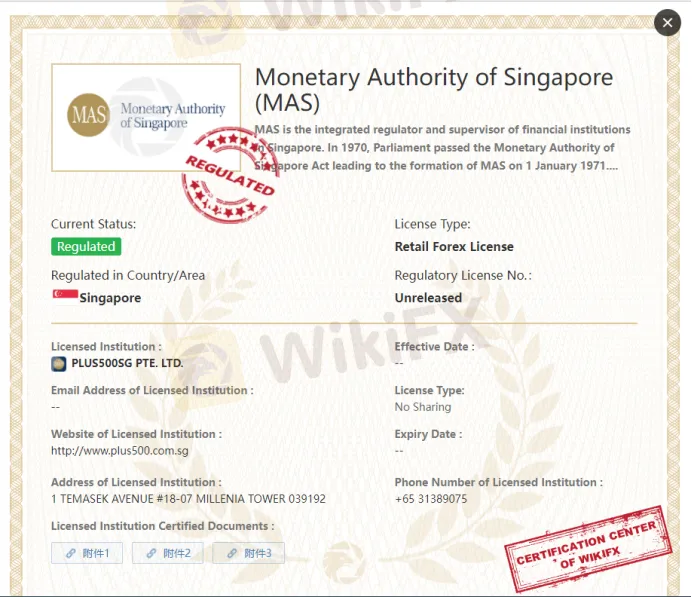

C. Fund Security

Account segregation is imperative since it allows traders to have access to their funds all the time. Even if the broker is bankrupt, traders will still be capable of getting their money back. However, it doesnt mention where exactly “client bank accounts” hold.

2. The feedback from Twitter

To figure out whether Plus500 is a scammer or not, we made a survey about Plus500 on Twitter.

Reviews on Twitter:

(Source:Twitter)

Plus500 has an official Twitter account, which is registered on May 2010. As of March 7th 2022, It has more than 91K followers.

One trader depicted that Plus500 is a regular platform that allows you to use leverage when you buy spot gold on crypto exchanges.

Another trader on Twitter claimed that Plus500 is a scammer. It blocked this traders account.

3. Exposure related to Plus500 on WikiFX

On WikiFX, the Exposure consists of feedback from traders. A bad track record of brokers can be checked via Exposure. WikiFXs Exposure function helps you get feedback from other traders and remind you of the risks before it starts.

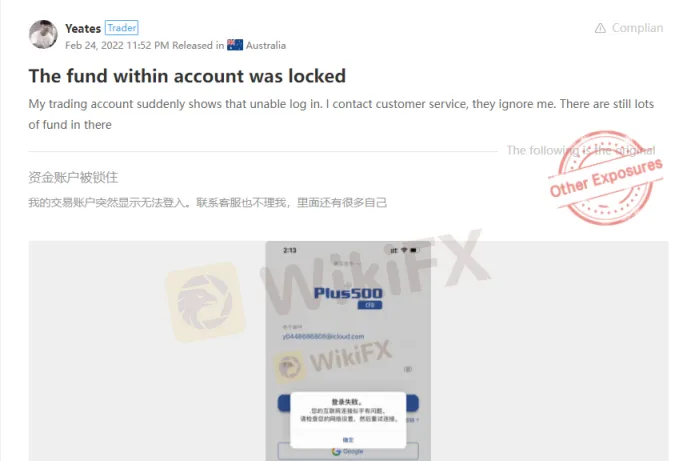

As of March 7 2022, the number of the complaints received by WikiFX against this broker reached 12 in the past 3 months. As we displayed below, some traders claimed that their accounts were blocked by Plus500, they could not make a withdrawal. Some traders said they faced serious slippage.

(source:WikiFX)

4. Special survey about Plus500 from WikiFX

A. Scoring Criteria

WikiFX gives brokers a score from 0 to 10. The higher the score is, the more reliable the broker is.

| The Scoring Criteria of Brokers on WikiFX |

| License index: reliability and value of licenses |

| Regulatory index: license regulatory strength |

| Business index: enterprise stability and operational capability |

| Software index: trading platform, instruments etc |

| Risk Management index: the degree of asset security |

Plus500 has been given by WikiFX a decent rating of 7.76/10.

(source:WikiFX)

According to the above, it seems that Plus500 is very poor at risk management. Risk management includes the measurement, assessment, and contingency strategy of risk. Ideally, risk management is a series of prioritized events. Plus500 seems not to have enough capital and good strategies to secure clients assets in the unstable market.

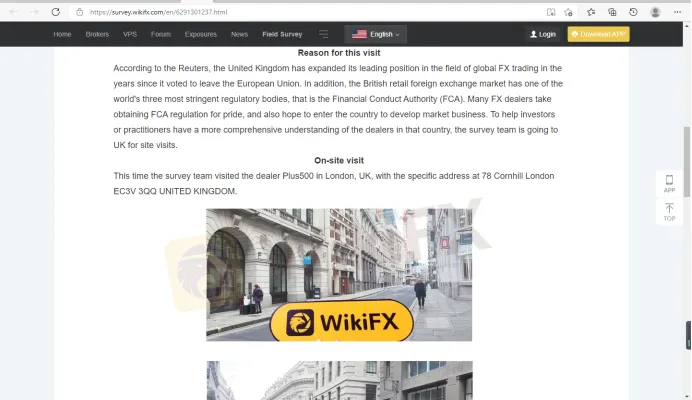

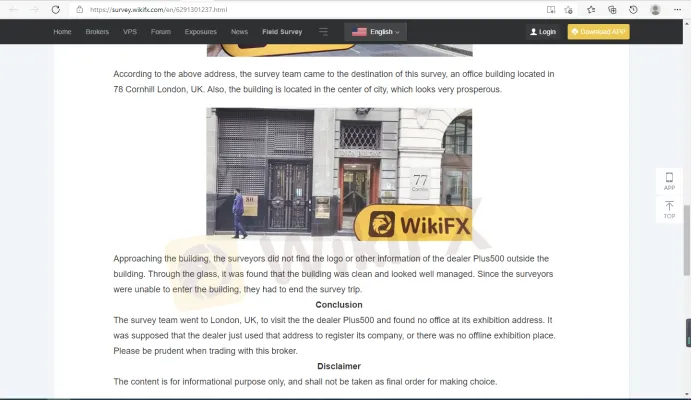

B. Field Investigation

To help you fully understand the broker, WikiFX also investigates the brokers by sending surveyors to the brokers physical addresses.

On WikiFX, you can visually check the physical addresses of brokers by pressing the “Survey” button.

WikiFX did make a on-site survey on Plus500 on May 2021 but failed to find their office.

(source:WikiFX)

C. WikiFX Alerts

| The number of the complaints received by WikiFX against Plus500 reached 12 in the past 3 months |

| The number of this broker's negative field survey reviews has reached 1 |

| Current data shows that this broker is using Non MT4/5 Software |

(source: WikiFX)

5. Conclusion:

Due to recent complaints, we advise you to do more research and make sure you fully understand the risks before making a decision. If you want to know more information about the reliability of certain brokers, you can open our website (https://www.WikiFX.com/en). Or you can download the WikiFX APP for free through this link (https://www.wikifx.com/en/download.html). Running well in both the Android system and the IOS system, the WikiFX APP offers you the easiest and most convenient way to seek the brokers you are curious about.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

WikiEXPO Dubai 2024 will take place soon!

2 Days Left!

Italian Regulator Warns Against 5 Websites

The Italian regulator, CONSOB has issued a warning against five websites offering unauthorized financial services. This regulatory action aims to protect the public from fraudulent activities.

WikiEXPO Dubai 2024 is coming soon

3 Days Left!

Trader Exposes Unethical Practices by STP Trading

A recent allegation against STP Trading has cast doubt on the firm's business practices, highlighting the potential risks faced by retail traders in an increasingly crowded and competitive market.

WikiFX Broker

Latest News

What Makes Cross-Border Payments Easier Than Ever?

Trader Exposes Unethical Practices by STP Trading

Italian Regulator Warns Against 5 Websites

Currency Calculator