简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Oil and gold prices surge to a high level amid the West's ban on Russian energy imports

Abstract:The conflict between Russia and Ukraine continues these days. Due to the unprecedented sanctions from the West, the risk of a Russian debt default is increasing. Foreign investors are rushing to pull their money out of Russia. And the price of most commodities, including oil, gold, has soared.

Key Background

The Russian invasion of Ukraine continues these days. Due to the unprecedented sanctions from the West, the risk of a Russian debt default is increasing. Foreign investors are rushing to pull their money out of Russia. And the price of most commodities, including oil, gold, has soared.

Back in 2021, Russia's share of global crude oil and natural gas exports reached 11.3% and 16.2%, respectively, and its share of EU crude oil and natural gas imports reached 27% and 35%, respectively. In addition, Russian crude accounted for 8 percent of U.S. liquid fuel imports.

(source:The Washington Post)

Still, according to The Washington Post, the Biden administration on March 8 banned imports of oil and natural gas from Russia to penalize them for invading Ukraine. Decisions made by the US to ban imports of Russian oil and the UK to phase them out by the end of the year may further make global energy markets unstable.

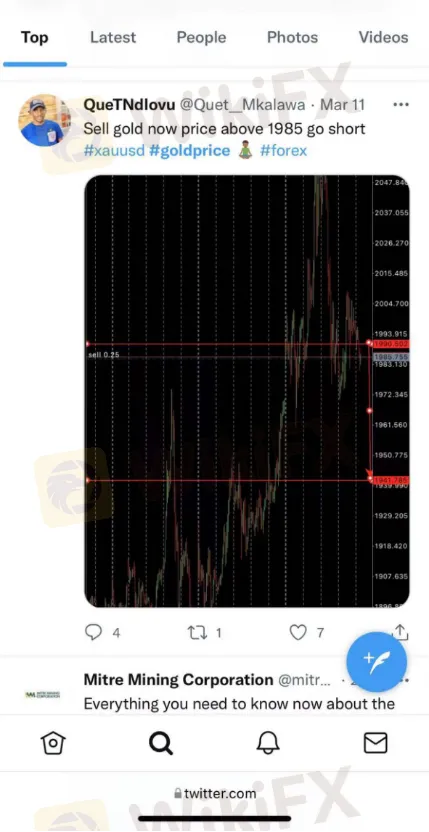

(source:Twitter)

Commodity prices skyrockets

Russia and Ukraine are important exporters of oil, natural gas, grain, metals, fertilizers, rare gases, and other commodities in the world, and the most important import source of these commodities is for Europe. The Russian invasion of Ukraine and European sanctions on Russia have sharply reduced Exports of Russian goods, pushing up prices.

On February 27, the West has restricted Russian access to SWIFT. Several Russian banks have been forced to quit this global payment system, which would be catastrophic for the International operations of the Russian financial system. Meanwhile, to resist sanctions, Russia's central bank raised its benchmark interest rate from 9.5% to 20%, the highest in 20 years, before the market opened on March 6.

Global investors need to re-examine the depth of the implications for the global economy. As there is still too much uncertainty about the ongoing war. Investors must be alert to the risk of commodities supply being disrupted by geopolitical events leading to significant production cuts, driving prices higher.

International oil prices soar continually

Oil prices have soared since the war escalated, with traders trying to steer clear of Russian oil amid western sanctions. Currently, 66 percent of Russian oil is struggling to find new buyers. As the Biden administration is working on sanctions towards Russian oil imports, the oil prices surged to their highest level since 2008. Global oil prices have spiked more than 60% since 2022. On March 3, JPMorgan Chase issued a research report predicting that international oil prices could soar to $185 if Russian oil supplies continue to suffer from the impact of European and US sanctions.

(source:Twitter)

On the other hand, Warren Edward Buffett's Berkshire Hathaway has increased its stake in Occidental Petroleum to 113 million shares worth $5.3 billion, according to a new Securities and Exchange Commission filing. Buffett's shares of Occidental oil are up 45% since February 28.

The oil price hike has a considerably negative impact on individuals. As the West bans crude oil from Russia, the ordinary people in most countries seem to face the oil price hike. The most direct influence is that they need to pay a way higher price than usual in order to fill in their cars‘ fuel tanks, which will increase people’s lives costs.

Gold price climbed to its highest price since August 2020.

Russian central bank is unable to sell its gold reserves in response to the sanctions since it is no longer able to access SWIFT. The global gold price rose above $2000.

According to Caitlin McCabe, the Wall Street Journey reporter, gold price surges above $2,000. The last time gold consistently traded above $2000 a troy ounce was in August 2020 when Covid-19 shake the global economic outlook. Growing uncertainty about the economic effects of the war in Ukraine has also benefited the U.S.dollar.

Gold Price surges affect investor sentiment. Golds record high is mainly a sign of increased uncertainty about the future economic outlook. As some international financial institutions predicted, if the gold price keeps surging, the investor risk aversion will increase.

As the Russia-Ukraine situation continues to escalate, staying focused on gold assets is becoming many investors choice. In addition, since Russia is under sanctions from western countries, it can be inferred that they will greatly strengthen cooperation with non-US dollar settlement countries and economies to save its economy. Recently, Russia's central bank announced that it would enter the market to buy gold for the second time in two years, after six years of increasing its gold holdings.

Gold Reserves in Russia increased to 2298.53 Tonnes in the third quarter of 2021 from 2292.31 Tonnes in the second quarter of 2021. (source: World Gold Council 3Y 10Y)

The West remains divided over sanctions against Russia's oil trade

According to recent reports, a ban on Russian crude would be hard to pull off. So far, there is no clear sign of a concrete plan among EU members. EU countries have so far acted in concert in response to Russia's invasion of Ukraine, and future decisions will be based on the same principle.

EU member states are divided over whether to join the United States in banning Russian oil imports. With several urging it as a way to increase pressure on Russian President Vladimir Putin. But some countries, such as Germany, oppose such a sudden move.

For now, German Chancellor Angela Scholz has opposed restrictions on oil trade, saying Russian oil exports are “vital to Europe's economy, and Europe cannot secure the energy supplies it needs for heating, transport, electricity, and industry from anywhere else,” He added that getting rid of Russia would not happen “overnight.” Europe had “deliberately exempted” Russian energy from sanctions because its supply cannot be secured “any other way” at the moment. In conclusion, he emphasized Europe does need to reduce its dependency on Russian energy, but it will take time.

Energy giant Shell recently vowed to impose sanctions on Russia. Although Shell announced sanctions against Russia on February 28, it still bought oil from Russia on March 5. Shell initially explained it had “no choice” but to buy Russian crude to keep fuel supplies in Europe stable. Previously, Shell reportedly bought 725,000 barrels of Russian crude oil at $28.50 a barrel lower than Brent. The company further stressed that without a continuous supply of crude to refineries, the energy industry could not guarantee the delivery of essential products across Europe in the coming weeks.

(source:Twitter)

However, according to Forbes, on March 8, the energy giant Shell has eventually pledged to stop buying Russian oil and gas, and will immediately stop buying Russian crude oil, as the firms boss apologized for purchasing discounted crude oil from Russia amid the ongoing invasion of Ukraine.

What is more

The sanction against Russian energy imports itself is a double-blade sword. It is no doubt that the daily lives of people in the West climb as global oil prices skyrockets. The war between Russia and Ukraine continues, but a new round of talks seems to show the world signs of peace.“We‘re looking for signs of peace.” says Peter Mallouk, president of Creative Planning. “If there is peace...we’re going to see a very sharp rebound in the market.” However, some experts said the current situation of the commodity can not be back to its normal track as the conflict may not end in a short time. Sameer Samana, a senior global market strategist at Wells Fargo Investment Research, said “We don't want to overreact when the uncertainty is so high. With geopolitical issues still lurking out there, it will be hard for markets to make meaningful progress.”

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Smart Prop Trader to Close Doors in December 2024

Smart Prop Trader, a proprietary trading firm known for offering funded trading accounts, has announced plans to cease onboarding new traders as it prepares to wind down operations by the end of the year.

Filipino Investment Scam Fugitive Deported from Indonesia

Hector Aldwin Pantollana, a Filipino investment scam suspect, is deported from Indonesia after scamming millions. Authorities vow justice for the victims.

XM Group: A Leading Multi-Asset Broker Honored for Exceptional Customer Experience and Service

XM Group, operating under the entity name XM Global Limited, has emerged as a prominent force in the global forex and derivatives trading industry, boasting over 15 million clients worldwide. Since its inception in 2009, XM has evolved into a reputable multi-asset broker, offering an extensive range of more than 1400 trading instruments across 10 asset classes. With a strong emphasis on corporate values, innovative technology, and exceptional customer service, XM has established itself as a true industry leader.

Unleash Your Trading Skills: Join the WikiFX KOL India Trading Competition!

Are you ready to take your trading expertise to the next level? WikiFX is excited to announce an extraordinary India Trading Competition designed to connect passionate forex traders, enhance user engagement, and reward trading excellence!

WikiFX Broker

Latest News

Unleash Your Trading Skills: Join the WikiFX KOL India Trading Competition!

NAGA Adds UAE, Saudi Stocks to Platform with Zero Commissions

Tether to Discontinue EURt Stablecoin Amid Regulatory Shifts in Europe

Adani’s Bribery Scandal! SEC Charges, Major Fallout & Adani’s Stand

Broker Review: Is FOREX.com a solid Broker?

Philippine Banks Launch PHPX Stablecoin to Transform Payments

Philippine Scam Ring Targets Aussie Men with Fake Crypto Offers

ED uncovered 106 Crore "Nagaland Crypto Scam"

Smart Prop Trader to Close Doors in December 2024

Meme Coins: Fleeting Fortune or Financial Folly?

Currency Calculator