简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Fed Ramps Up Hawkish Talk; Tech Sells Off, Dip-buyers Return

Abstract:In what seemed like a dress rehearsal for a more sustained taper tantrum, US markets sold off last week when Fed minutes released from Decembers FOMC

In what seemed like a dress rehearsal for a more sustained taper tantrum, US markets sold off last week when Fed minutes released from Decembers FOMC meeting suggested that the central bank was considering hiking interest rates sooner, and more aggressively, than expected.

Normally FOMC meeting minutes are somewhat of a non-event as the major insights tend to be communicated during the post-meeting press conference. However, this year weve had at least two occasions when the release of the minutes has spooked markets into a risk-off mood.

Yields up, stocks down

A combination of soft PMI data, down to 58.7 in December from 61.1 in November, along with a contraction in JOLTS job openings, caused US markets to sell off on Tuesday, January 4. This set the stage for a more pronounced rout on Wednesday when the minutes were released.

The bond market sold off, which had the effect of spooking tech stocks, particularly as 10-year yields rose to 1.764% for the first time since March of last year. Crypto also took a significant hit; the broad market was down by around 6% on the day as investors with paper profits from 2021 begin to weigh how slowing growth and a more hawkish Fed are likely to dampen the enthusiasm for risk assets.

The S&P 500 was down over 1.8% on the day. The Nasdaq 100 fell by around 2.7%, and the Russell 2000 dropped by more than 3.3%.

Sector rotation?

A great deal has been made recently about the fact that the percentage of Nasdaq 100 stocks that are down by 50% or more from their 52-week highs is almost at record highs. We haven‘t seen a situation when so many of the index’s stocks are down despite it trading close to highs since the dot-com bubble of 2000.

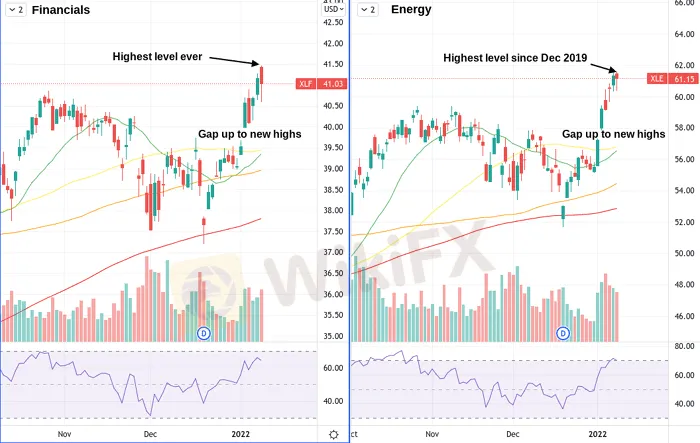

The best performing sectors in the first week of January, following the selloff, were Financials and Energy, up 7% and 4% on the week, respectively. This has caused many to speculate about a broader sector rotation. Whether this proves to be the case or not, you can see the markets concerns present in this mini rotation. Financials are set to perform well in an environment of rising rates. Also, with inflation concerns still front and centre, and the worst of the winter still not over with, energy seems like a smart bet for many investors.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

WikiEXPO Dubai 2024 will take place soon!

2 Days Left!

WikiEXPO Dubai 2024 is coming soon

3 Days Left!

WikiEXPO Dubai 2024 is set to open!

4 Days Left

7 Days Left!WikiEXPO Dubai 2024 is about to make a stunning debut!

Seeing Diversity Trading Safely

WikiFX Broker

Latest News

Saxo & Portuguese Bank Partnership

SEC Fines Broker-Dealers $275K for Incomplete SAR Filings

Lured by False Promises: Malaysian Driver Lost RM218K to an Investment Scam

FTX Sets March 2025 Timeline for Creditor Payouts: What It Means for Investors

What is an Economic Calendar? How it works

Italian Regulator Warns Against 5 Websites

SFC Freezes $91M in Client Accounts Amid Fraud Probe

Bybit Launches Gold & FX Treasure Hunt with Real Gold Rewards

Mastercard's 2030 Vision: Biometric-Driven, Tokenized Payments

What Are the Latest Trends and Strategies in Philippine Gold Trading?

Currency Calculator