简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

WikiFX best rated forex brokers operating in Nigeria for 2021.

Abstract:There exists a lot of brokers functioning in Nigeria. This is supported by the very large population of the country and the craze for online job opportunities by the citizens. Many brokers have therefore emerged to compete in the Nigerian Forex Market. However IC Markets has emerged the best Wikifx rated broker operating in Nigeria for the year 2021. Below are a list of best rated Forex brokers by Wikifx operating in Nigeria.

By: Damian Okonkwo

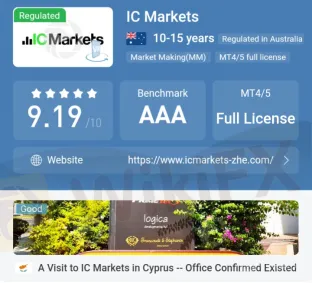

A. IC Markets - Score 9.19/10

This broker has emerged Wikifx most recommended broker for the year 2021. This broker was founded in 2007 with headquarters in Sydney Australia. IC Markets specializes in CFDs over Forex, stock indices, commodities, bonds, and equity markets in Asia, Latin America, Middle East, Australia and Europe and extensions in Nigeria. IC Markets is regulated in Australia and Cyprus by ASIC and CYSEC respectively.

Wikifx has so much recommended this broker and lauded the quality of its customers service provision as always responding and resolving all customers complaints within seven working days.

B. Exness - Score 8.99/10

This is the second highest rated broker by Wikifx in 2021. Exness brokerage services was established in 2008.

Exness has built a strong record of excellence in the industry over the years, especially in the regions where they operate including Nigeria. This broker is fully regulated by a number of regulators such as: FCA, CYSEC, FSA and FSCA. Exness has a very good deposit and withdrawal scheme for all investors in their local currency. They have a very excellent customers support to attend to all investors complaints.

C. XM - Score 8.99/10

XM is the third highly rated broker by Wikifx. This broker was established in 2007 with branches in various regions across Asia, Africa (South Africa, Nigeria) and UK. This broker has a multiple regulators such as: ASIC, CYSEC, IFSC, FSA and DFFSA.

XM has a very strong recommendations from Wikifx and a very good customer support services. Their minimum deposit is $100.

D. EightCap - Score 8.44/10

This is the 5th highest ranked broker according to Wikifx rankings. This broker was established in 2008 and regulated by ASIC, FCA, VFSC and SCB. This broker only supports the major currencies deposits like USD, GBP and EUR, but does not support minor currencies. All local Currencies deposited are automatically converted to these major currencies and a little conversion fee deducted. The minimum deposit for trading with this broker is $100.

E. Easy Markets - Score 8.35/10

Easy markets is the 8th highest ranked broker operating in Nigeria according to Wikifx rankings. This broker is fully regulated by ASIC, CYSEC, FSA and FSCA. This broker has a minimum deposit of $100. Easy markets offers several unique features attractive to beginners through its proprietary trading platform. However, easyMarkets is pricey, offers only a small selection of tradeable products, and does not provide special market research for traders on their platforms.

F. Ava Trade - Score 8.03/10

Ava Trade is another broker operating in Nigeria Regulated by Tier 1 regulators: ASIC Australia, FSA Japan, FSCA South Africa. This broker is the 49th highly ranked broker according to Wikifx rankings.

AvaTrade offers an extensive selection of trading platforms for forex and CFD traders, as well as exceptional educational content that helps beginners to learn about the market. They equally provide a copy trades option for beginners in their platforms.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

WikiEXPO Dubai 2024 is coming soon

3 Days Left!

WikiEXPO Dubai 2024 is set to open!

4 Days Left

7 Days Left!WikiEXPO Dubai 2024 is about to make a stunning debut!

Seeing Diversity Trading Safely

BSP Set to Follow Fed's Rate Cuts to Stabilize PH Peso vs USD

Philippines Central Bank (BSP) is set to follow the Fed's rate cuts to stabilize the PH Peso over USD, maintaining a favorable interest rate spread and supporting the economy.

WikiFX Broker

Latest News

Hackers Charged for $11M Crypto Theft Using SIM-Swaps

Role of Central Banks in the FX Market

FCA Alerts Against Sydney FX

What Makes Cross-Border Payments Easier Than Ever?

Trader Exposes Unethical Practices by STP Trading

Malaysian Man Loses RM113,000 in Foreign Currency Investment Scam

Bitcoin Nears $100,000: A Triumph of Optimism or a Warning Sign?

Mastercard Partners with JPMorgan for B2B Cross-Border Payments

FCA Identifies Clone Firm Exploiting Admiral Markets' Credibility

Coinbase Under Scrutiny Amid Wrapped Bitcoin Delisting Controversy

Currency Calculator