简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Yen and US Dollar May Rise Further on OECD Outlook, BOC Rate Call

Abstract:The Japanese Yen and US Dollar may continue to rise as an OECD forecast update and BOC policy decision stoke global slowdown fears and sour

TALKING POINTS – YEN, US DOLLAR, AUSSIE DOLLAR, OECD, BANK OF CANADA

Yen, US Dollar rise as most G10 FX splits along risk on/off divide

Aussie Dollar suffers outsized losses on GDP data, dovish Lowe

OECD outlook update, BOC rate call may sustain defensive tone

Most currency market price action appeared to be divided along sentiment lines in Asia Pacific trade, even as regional stocks turned in a mixed performance. The anti-risk Japanese Yen and US Dollar traded broadly higher while the sentiment-geared Australian and New Zealand Dollars suffered outsized losses.

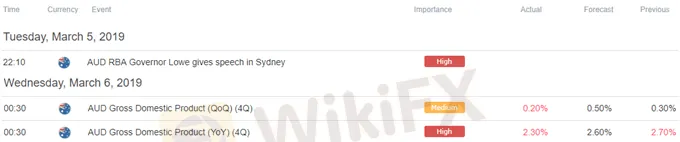

The Aussie was particularly weak in the wake of disappointing GDP data as well as pointedly dovish comments from RBA Governor Philip Lowe. He said it is “hard to see a scenario where rates rise this year,” adding that it is unlikely that inflation will be a problem any time soon.

The British Pound diverged from the risk on/off dynamic. It traded lower following a Reuters report saying that Brexit talks between EU and UK negotiators failed to reach a deal on Tuesday. Talks in Brussels are set to resume today.

OECD OUTLOOK UPDATE, BOC RATE DECISION MAY SPOOK MARKET

Looking ahead, an updated economic outlook from the OECD and a policy decision from the Bank of Canada are in focus. The former may echo recent downgrades from similar entities like the IMF and World Bank. The latter might take a similarly downbeat view, echoing recent weakness in local and US data flow.

Taken together, these might offer fresh fodder to building concerns about global economic slowdown, cooling risk appetite. In fact, bellwether S&P 500 are pointing tellingly lower, perhaps in anticipation of just such an outcome. If it materializes, APAC-session G10 FX price moves might find scope for follow-through.

What are we trading? See the DailyFX teams top trade ideas for 2019 and find out!

ASIA PACIFIC TRADING SESSIO

EUROPEAN TRADING SESSIO

** All times listed in GMT. See the full economic calendar here.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Safe-haven yen, Swiss franc rise on Omicron fears, Fed policy uncertainty

The dollar ticked higher on Friday amid a broadly calmer tone in markets as fears over Omicron’s impact eased, but currency moves were muted ahead of a key U.S. payrolls report that could clear the path to earlier Federal Reserve interest rate hikes.

Safe-haven yen, Swiss franc rise on Omicron fears, Fed policy uncertainty

The dollar ticked higher on Friday amid a broadly calmer tone in markets as fears over Omicron’s impact eased, but currency moves were muted ahead of a key U.S. payrolls report that could clear the path to earlier Federal Reserve interest rate hikes.

Japanese Yen Caught Out on Fed Hawkishness and Omicron. Will USD/JPY Break?

The Japanese Yen weakened on Fed Chair Powell confirmed hawkishness. APAC equities were mixed, and crude oil remains mired before OPEC+. Omicron universal uncertainty continues. Will USD/JPY gain traction?

US Dollar Leaps on Fed Re-Nomination Pumping Up Treasury Yields. Will USD Keep Going?

The US Dollar rode higher as US yields rose across the curve. Crude oil prices recovered after OPEC+ threw a curve ball. With Thanksgiving almost here, where will USD go on holiday?

WikiFX Broker

Latest News

Unleash Your Trading Skills: Join the WikiFX KOL India Trading Competition!

NAGA Adds UAE, Saudi Stocks to Platform with Zero Commissions

Tether to Discontinue EURt Stablecoin Amid Regulatory Shifts in Europe

Adani’s Bribery Scandal! SEC Charges, Major Fallout & Adani’s Stand

Kraken Closes NFT Marketplace Amid New Product Focus

Robinhood Launches Ethereum Staking with 100% Rewards Match

Broker Review: Is FOREX.com a solid Broker?

Philippine Banks Launch PHPX Stablecoin to Transform Payments

Philippine Scam Ring Targets Aussie Men with Fake Crypto Offers

ED uncovered 106 Crore "Nagaland Crypto Scam"

Currency Calculator