Score

MC

China|2-5 years|

China|2-5 years| https://www.xtmcic.com/

Website

Rating Index

Contact

Licenses

No valid regulatory information, please be aware of the risk!

Single Core

1G

40G

Contact number

Other ways of contact

Broker Information

More

MC环球投资

MC

China

Pyramid scheme complaint

Expose

Check whenever you want

Download App for complete information

- It has been verified that this broker currently has no valid regulation. Please be aware of the risk!

- The number of the complaints received by WikiFX have reached 9 for this broker in the past 3 months. Please be aware of the risk and the potential scam!

WikiFX Verification

Users who viewed MC also viewed..

XM

FP Markets

MiTRADE

STARTRADER

MC · Company Summary

| Aspect | Information |

| Registered Country/Area | China |

| Founded Year | 2-5 years |

| Company Name | MC环球投资 |

| Regulation | Not regulated |

| Minimum Deposit | $100 |

| Maximum Leverage | Up to 1:500 |

| Spreads | Typically 0.2 - 1.0 pips for major currency pairs |

| Trading Platforms | Meta Trader 4 |

| Tradable Assets | Equity, debt, currency, commodity markets |

| Account Types | Standard, Premium, VIP |

| Demo Account | Not specified |

| Islamic Account | Not specified |

| Customer Support | Email (service@xtmcic.com) |

| Payment Methods | Bank wires, credit cards, debit cards |

| Educational Tools | Video tutorials, webinars, eBooks, trading simulator |

Overview of MC

MC is a China-based company that offers a variety of market instruments for trading. However, it is important to note that MC lacks valid regulation and has received multiple complaints within the past three months, suggesting potential risks and fraudulent activities. Traders should exercise caution and carefully consider the associated risks before engaging with MC.

MC环球投资 provides market instruments in different categories. In the equity market, they offer common stocks, preferred stocks, and exchange-traded funds (ETFs) from well-known companies. Their debt market instruments include government bonds, corporate bonds, and municipal bonds. For currency trading, MC offers foreign exchange, currency futures, and currency options. In the commodity market, they provide instruments such as oil, gold, silver, and corn.

Account types offered by MC环球投资 include the Standard Account, which is the basic option with no additional features, and the Premium Account, which provides benefits like an account manager and priority customer support. The VIP Account is the most exclusive offering, designed for high-net-worth individuals and professional traders, and includes privileges such as a personal trading advisor and exclusive events.

However, traders should be aware of the lack of regulation, the complaints received, and exercise caution when considering MC环球投资 as a trading option.

Pros and Cons

MC offers a variety of equity, debt, currency, and commodity instruments, providing investors with diverse options for their trading activities. Additionally, they provide different account types with varying features and benefits, catering to the needs of different types of traders. The company also offers leverage up to 1:500 on some trading instruments, allowing traders to potentially amplify their profits. Moreover, MC环球投资 allows deposits and withdrawals through various methods like bank wires, credit cards, and debit cards. The broker offers spreads starting from 0.2 pips and provides educational resources such as video tutorials, webinars, and eBooks to assist traders in expanding their knowledge. The user-friendly Meta Trader 4 trading platform further enhances the trading experience. However, it is important to note that MC环球投资 lacks valid regulation, which poses a significant risk for investors. There have been noted complaints and potential presence of scams or fraudulent activities. Customers have reported discrepancies between quoted prices and those on MT4, and the main website is currently down. Additionally, there is no demo account available, and an inactivity fee is imposed if the account balance falls below $100. The customer support provided is limited in scope. Traders should consider these pros and cons carefully before engaging with MC环球投资.

| Pros | Cons |

| Offers a variety of equity, debt, currency, and commodity instruments | Lacks valid regulation, posing a significant risk for investors |

| Provides different account types with varying features and benefits | Noted complaints and potential presence of scams or fraudulent activities |

| Offers leverage up to 1:500 on some trading instruments | Discrepancies between quoted prices and those on MT4 |

| Allows deposits and withdrawals via bank wires, credit cards, and debit cards | No demo account available |

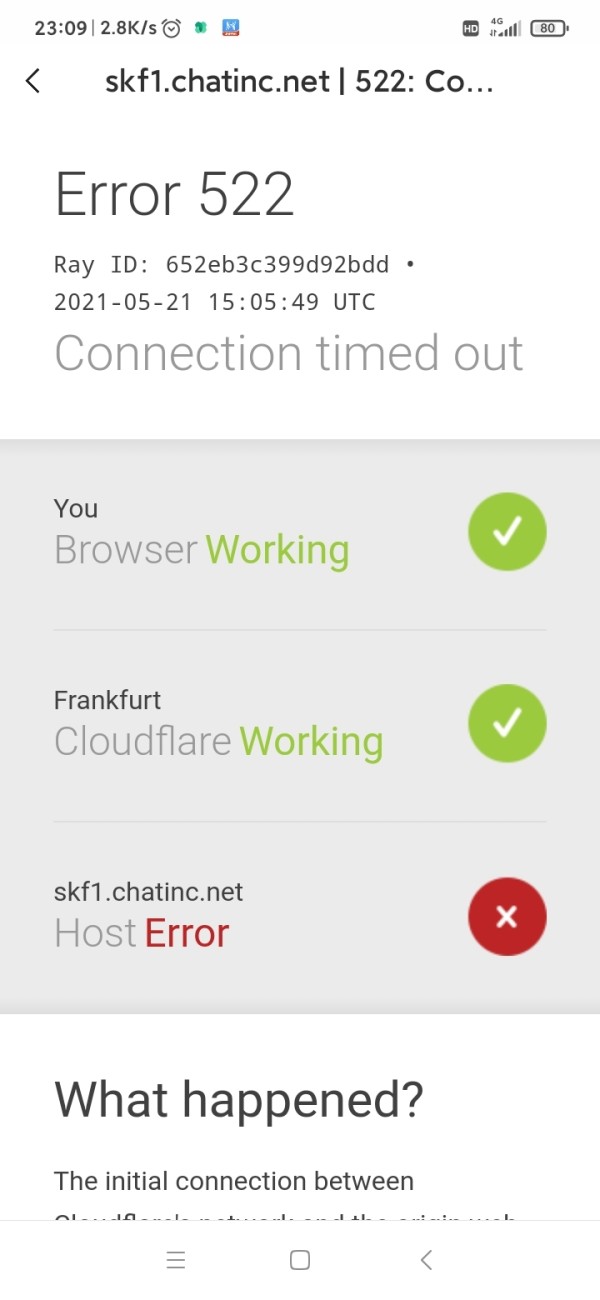

| Spreads from 0.2 pips | Main website is currently down |

| Provides educational tools such as video tutorials, webinars, and eBooks | Inactivity fee imposed if the account balance is below $100 |

| User-friendly Meta Trader 4 trading platform | Limited customer support |

Is MC Legit?

It is important to note that the mentioned broker lacks valid regulation, as confirmed through verification. This absence of regulation poses a significant risk for potential investors. Additionally, WikiFX has received a notable number of 9 complaints regarding this particular broker within the past 3 months, indicating the potential presence of scams or fraudulent activities. It is advised to exercise caution and carefully consider the risks involved before engaging with this broker.

Market Instruments

EQUITY:

MC环球投资 offers a variety of equity market instruments, including common stocks, which represent ownership in a company. They also provide preferred stocks, which have a higher priority than common stocks when it comes to dividends and liquidation. Additionally, they offer exchange-traded funds (ETFs), which are baskets of stocks that can be traded on an exchange. Some examples of common stocks include shares of Apple, Microsoft, and Amazon. Preferred stocks can include those issued by major banks like JPMorgan Chase and Wells Fargo. ETFs can include popular options such as the SPDR S&P 500 ETF and the Vanguard Total Stock Market ETF.

DEBT:

MC环球投资 also offers a variety of debt market instruments. This includes government bonds, which are issued by governments. They also provide corporate bonds, which are issued by companies and may offer higher yields than government bonds, but carry more risk. Additionally, MC环球投资 offers municipal bonds, which are issued by state and local governments and are exempt from federal income tax. Examples of government bonds can include U.S. Treasury bonds and German bunds. Corporate bonds can include offerings from companies like Apple, Microsoft, and General Electric. Municipal bonds can include those issued by cities such as New York City or Los Angeles.

CURRENCY:

MC环球投资 offers a variety of currency market instruments. This includes foreign exchange, which refers to the buying and selling of currencies. They also provide currency futures, which are contracts to buy or sell a currency at a specified price on a future date. Additionally, they offer currency options, which give the holder the right, but not the obligation, to buy or sell a currency at a specified price on a future date. Examples of currency pairs that can be traded include EUR/USD, GBP/JPY, and AUD/CAD. Currency futures contracts can involve trading the Japanese yen, Swiss franc, or British pound. Currency options can include options on the euro, Japanese yen, or Australian dollar.

COMMODITY:

MC环球投资 offers a variety of commodity market instruments. This includes oil, which is a major commodity used for transportation and energy production. They also provide gold, a precious metal often used as a hedge against inflation. Additionally, they offer silver, another precious metal used in jewelry and electronics. Furthermore, MC环球投资 offers corn, which is a major agricultural commodity used for food and feed. Examples of oil instruments that can be traded include West Texas Intermediate (WTI) crude oil and Brent crude oil. Gold instruments can include spot gold and gold futures contracts. Silver instruments can include spot silver and silver ETFs. Corn instruments can include corn futures contracts and agricultural commodity ETFs.

Pros and Cons

| Pros | Cons |

| Offers a variety of equity, debt, currency, and commodity instruments | Lacks valid regulation, posing a significant risk for investors |

| Provides exposure to major market segments, including stocks, bonds, currencies, and commodities | Limited information on margin requirements and contract specifications |

| Enables potential diversification and investment opportunities across different asset classes | Market volatility and potential for price fluctuations |

Account Types

Standard Account:

The Standard Account is the most basic account type offered by MC环球投资. It requires a minimum deposit of $100 and provides access to all the trading platforms and instruments available. However, it does not offer any additional features or benefits beyond the standard trading experience.

Premium Account:

The Premium Account requires a minimum deposit of $1,000 and includes all the features and benefits of the Standard Account. In addition, clients with a Premium Account enjoy advantages such as an account manager, increased leverage options, lower spreads, and priority customer support. These added perks are designed to enhance the trading experience for more experienced traders.

VIP Account:

The VIP Account is the most exclusive offering from MC环球投资, requiring a minimum deposit of $10,000. It encompasses all the features and benefits of the Standard and Premium Accounts. On top of that, VIP Account holders receive special privileges such as a personal trading advisor, exclusive events and webinars, and access to a trading platform. These additional perks cater specifically to the needs of high-net-worth individuals and professional traders.

Pros and Cons

| Pros | Cons |

| Provides access to all trading platforms and instruments | Limited information on fees and conditions for each types of accounts |

| Provide three types of accounts | VIP Account requires a high minimum deposit of $10,000 |

| Lower spreads and increased leverage options for Premium Account | No demo account available |

Leverage

MC offers leverage up to 1:500 on some trading instruments. This means that for every $1 you deposit, you can control a position worth up to $500. However, it is important to note that leverage can magnify both your profits and losses. Therefore, it is important to use leverage carefully and only with funds that you can afford to lose.

Spreads & Commissions

MC's spreads are typically between 0.2 and 1.0 pips for major currency pairs. MC环球投资 does not charge commissions on most trades. However, there is a $30 inactivity fee per month if the account balance is below $100.

Minimum Deposit

The minimum deposit amount for MC环球投资 is $100. This means that customers must deposit at least $100 in order to open an account with the company. The minimum deposit amount applies to all deposit methods, including bank wire, credit card, and debit card.

Deposit & Withdrawal

MC环球投资 allows customers to deposit and withdraw funds using bank wires, credit cards, and debit cards. The minimum deposit amount is $100 and the maximum deposit amount is $100,000. The minimum withdrawal amount is $100 and the maximum withdrawal amount is $10,000 per day. Processing times for deposits and withdrawals vary depending on the method used, but typically take 1-3 business days.

Pros and Cons

| Pros | Cons |

| Multiple deposit and withdrawal options | No information on withdrawal fees |

| Reasonable minimum deposit and withdrawal amounts | Limited maximum withdrawal amount per day |

| Reasonable processing times for deposits and withdrawals | Lack of transparency regarding processing times |

Trading Platforms

MC环球投资 offers the Meta Trader 4 trading platform, which is available for Windows users. Meta Trader 4 is a widely recognized and popular trading platform known for its user-friendly interface and comprehensive features. It provides traders with a range of tools for market analysis, order execution, and portfolio management. Windows users can take advantage of the Meta Trader 4 platform to access the financial markets.

Pros and Cons

| Pros | Cons |

| Offers Meta Trader 4, a widely recognized and popular trading platform | No support for other operating systems |

| User-friendly interface and comprehensive features | Limited customization options for advanced traders |

| Provides a range of tools for market analysis, order execution, and portfolio management | May require additional resources |

Educational Tools

Video Tutorials

MC offers a library of video tutorials that cover a wide range of topics, from basic trading concepts to advanced strategies. These tutorials are designed to help traders of all levels learn the skills they need to be successful.

Webinars

MC hosts regular webinars with industry experts to discuss current market trends and trading strategies. These webinars are a great way to learn from experienced traders and stay up-to-date on the latest market developments.

eBooks

MC offers a number of eBooks that provide comprehensive overviews of different trading topics. These eBooks are a great way to learn about specific trading strategies or to get a general understanding of the trading markets.

Trading Simulator

MCs trading simulator allows users to practice trading in a risk-free environment. This is a great way to learn how to trade without risking any real money.

Customer Support

MC offers customer support through email. Clients can reach out to the customer support team by sending an email to service@xtmcic.com. This provides a direct and channel for communication, allowing clients to seek assistance, raise inquiries, or address any concerns they may have.

Reviews

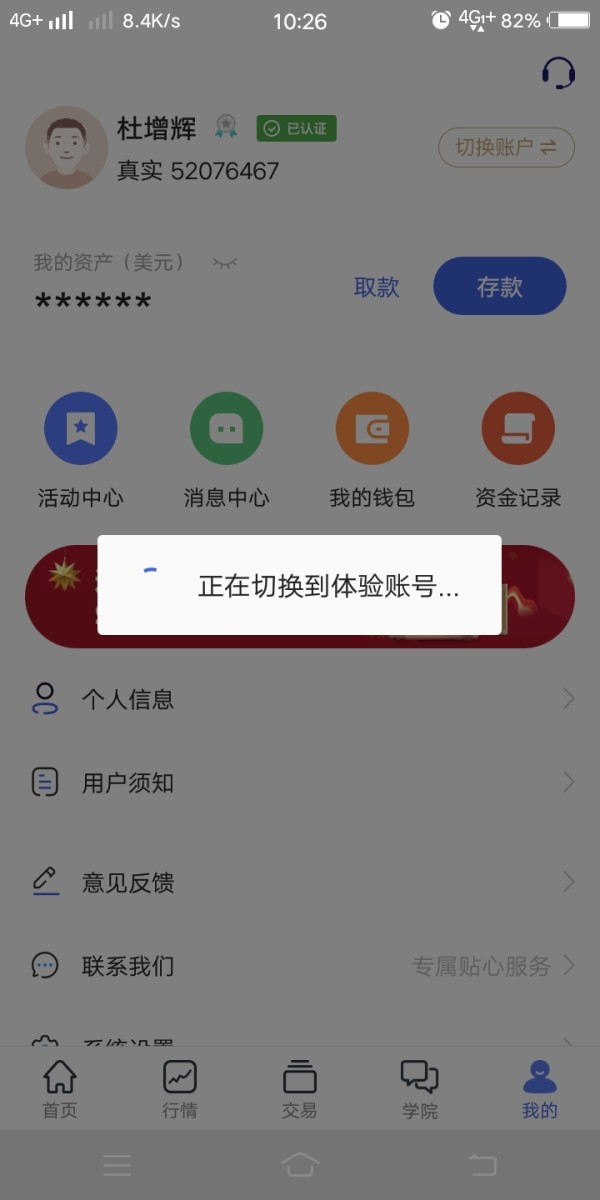

According to the reviews on WikiFX, there have been several concerns raised by customers regarding MC环球投资. Some customers reported abnormal price spreads, discrepancies between quoted prices and those on MT4, and difficulties in contacting customer service. Additionally, there were complaints about login issues, a fake platform, and problems with fund withdrawals. Customers expressed frustration with network disconnections, loading delays, and instances where stop-loss levels were triggered seemingly without reason. These reviews highlight various issues and challenges faced by users of MC环球投资.

Conclusion

In conclusion, it is important to note that MC环球投资 lacks valid regulation, which poses a significant risk for potential investors. Additionally, there have been numerous complaints reported regarding this broker, suggesting the potential presence of scams or fraudulent activities. While MC环球投资 offers a variety of market instruments across different asset classes, such as equity, debt, currency, and commodities, and provides multiple account types with varying features, including leverage options, lower spreads, and priority customer support for premium account holders, it is crucial to exercise caution and carefully consider the risks involved before engaging with this broker. Moreover, the trading platforms and educational tools, such as video tutorials, webinars, eBooks, and a trading simulator, are available to enhance the trading experience; however, there have been concerns raised about customer support, including difficulties in contacting them and various issues related to the platform's functionality and fund withdrawals reported by customers. These factors highlight the potential drawbacks and challenges associated with MC环球投资.

FAQs

Q: Is MC a legitimate company?

A: MC lacks valid regulation and has received complaints, indicating potential risks and fraudulent activities. Caution is advised.

Q: What market instruments does MC offer?

A: MC offers equity (common stocks, preferred stocks, ETFs), debt (government bonds, corporate bonds, municipal bonds), currency (foreign exchange, currency futures, currency options), and commodity (oil, gold, silver, corn) instruments.

Q: What are the account types offered by MC?

A: MC offers Standard, Premium, and VIP accounts, each with varying features and benefits.

Q: Does MC provide leverage?

A: Yes, MC offers leverage up to 1:500 on certain trading instruments. However, leverage carries both potential profits and losses.

Q: What are the spreads and commissions at MC?

A: Spreads range from 0.2 to 1.0 pips for major currency pairs, and there are no commissions on most trades. An inactivity fee of $30 per month applies if the account balance is below $100.

Q: What is the minimum deposit for MC?

A: The minimum deposit for MC is $100, applicable to all deposit methods.

Q: How can funds be deposited and withdrawn from MC?

A: MC allows bank wires, credit cards, and debit cards for deposits and withdrawals, with varying processing times.

Q: What trading platform does MC offer?

A: MC offers the Meta Trader 4 platform, known for its user-friendly interface and comprehensive features.

Q: What educational tools are provided by MC?

A: MC offers video tutorials, webinars, eBooks, and a trading simulator for learning and practicing trading.

Q: How can I contact MC's customer support?

A: Customer support can be reached through email at service@xtmcic.com.

Q: What are the reviews saying about MC?

A: Reviews on WikiFX mention concerns such as abnormal price spreads, platform discrepancies, difficulties with customer service, login issues, fake platforms, fund withdrawal problems, and technical glitches.

Review 10

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now