Score

EURO PRIME

Cyprus|5-10 years|

Cyprus|5-10 years| https://www.europrime.com/

Website

Rating Index

Contact

Licenses

Single Core

1G

40G

Contact number

+35726030155

+442038689977

Other ways of contact

Broker Information

More

IOS INVESTMENTS Limited.

EURO PRIME

Cyprus

Pyramid scheme complaint

Expose

Check whenever you want

Download App for complete information

- It has been verified that this broker currently has no valid regulation. Please be aware of the risk!

- The BelizeFSC regulation (license number: IFSC/60/511/TS/18) claimed by this broker is suspected to be clone. Please be aware of the risk!

- The Belize FSC regulation with license number: IFSC/60/511/TS/18 is an offshore regulation. Please be aware of the risk!

WikiFX Verification

| Benchmark | -- |

|---|---|

| Maximum Leverage | 1:500 |

| Minimum Deposit | $250,000 |

| Minimum Spread | -- |

| Products | -- |

| Currency | -- |

|---|---|

| Minimum Position | -- |

| Supported EA | |

| Depositing Method | -- |

| Withdrawal Method | -- |

| Commission | -- |

| Benchmark | -- |

|---|---|

| Maximum Leverage | 1:500 |

| Minimum Deposit | $100,000 |

| Minimum Spread | -- |

| Products | -- |

| Currency | -- |

|---|---|

| Minimum Position | -- |

| Supported EA | |

| Depositing Method | -- |

| Withdrawal Method | -- |

| Commission | -- |

| Benchmark | -- |

|---|---|

| Maximum Leverage | 1:500 |

| Minimum Deposit | $25,000 |

| Minimum Spread | -- |

| Products | -- |

| Currency | -- |

|---|---|

| Minimum Position | -- |

| Supported EA | |

| Depositing Method | -- |

| Withdrawal Method | -- |

| Commission | -- |

| Benchmark | -- |

|---|---|

| Maximum Leverage | 1:500 |

| Minimum Deposit | $250 |

| Minimum Spread | -- |

| Products | -- |

| Currency | -- |

|---|---|

| Minimum Position | -- |

| Supported EA | |

| Depositing Method | -- |

| Withdrawal Method | -- |

| Commission | -- |

- Fundamental Item(A)

- Total Supplementary Items(B)

- Debt Amount(C)

- Non-Fixed Capital(A)+(B)-(C)=(D)

- Relative amount of risk(E)

- Market Risk

- Transaction Risk

- Underlying Risk

Capital

$(USD)

Users who viewed EURO PRIME also viewed..

XM

HFM

MultiBank Group

FXCM

EURO PRIME · Company Summary

| Aspect | Information |

| Company Name | EuroPrime |

| Registered Country/Area | Cyprus |

| Founded Year | 2019 |

| Regulation | Unregulated(Suspicious Clone) |

| Minimum Deposit | $250 |

| Maximum Leverage | 1:400 |

| Spreads | Starting from 1.0 pips |

| Trading Platforms | MetaTrader 4 (MT4) |

| Tradable Assets | CFDs, futures, commodities, listed options, stocks, bonds, ETFs, mutual funds, managed portfolios |

| Account Types | Standard, Silver, Gold, Platinum and Islamic account |

| Customer Support | Phone: +35726030155, Email: support@europrime.com |

| Deposit & Withdrawal | Visa, MasterCard, Visa Debit, Visa Electron, MasterCard Debit. |

| Educational Resources | Articles, video tutorials, webinars, e-books |

Overview of EuroPrime

EuroPrime, established in Cyprus in 2019, presents a trading platform with a wide range of financial instruments. However, it's crucial to note that EuroPrime's regulatory status is currently a matter of concern as it is classified as a “Suspicious Clone” and lacks proper authorization.

While it claims to possess a “Retail Forex License” under Belize's regulation with license number IFSC/60/511/TS/18, this assertion requires careful consideration due to potential oversight issues. EuroPrime's offering includes various leveraged instruments like CFDs, futures, commodities, and listed options. Moreover, it provides investment opportunities through stocks, bonds, ETFs, mutual funds, and managed portfolios, enabling traders to diversify their investment portfolios.

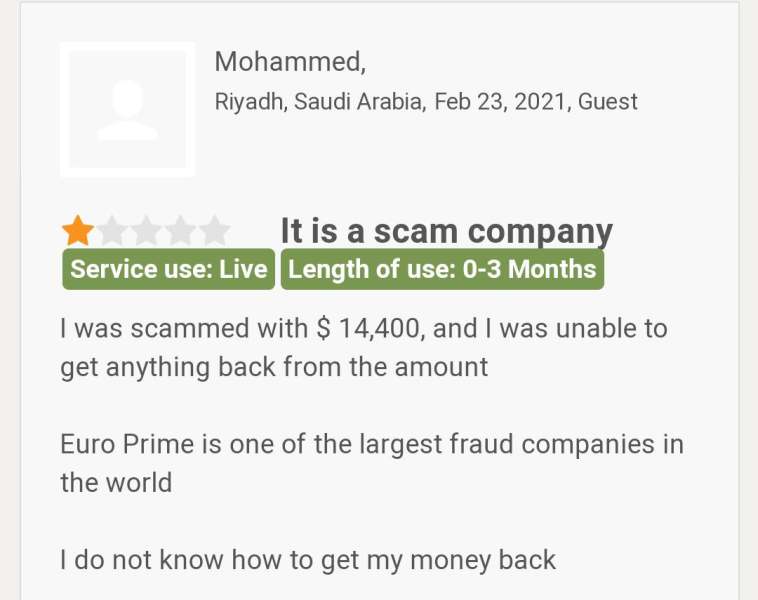

Is EURO PRIME legit or a scam?

EuroPrime's regulatory status raises concerns as it is currently categorized as a “Suspicious Clone” and operates without proper authorization.

It claims to hold a “Retail Forex License” under the regulation of Belize, with the license number IFSC/60/511/TS/18. However, this information should be approached with caution as it may not guarantee adequate oversight.

Pros and Cons

| Pros | Cons |

| Comprehensive Range of Trading Assets | Regulatory Concerns |

| Multiple Account Types | Lack of Transparency |

| MetaTrader 4 (MT4) Platform | High Minimum Deposit |

| Competitive Spreads | Limited Payment Methods |

| Educational Resources |

Pros:

Comprehensive Range of Trading Assets: EuroPrime offers a diverse selection of leveraged instruments, including CFDs, futures, commodities, and listed options, as well as investment products such as stocks, bonds, ETFs, mutual funds, and managed portfolios, allowing traders to diversify their portfolios.

Multiple Account Types: EuroPrime provides various account types, catering to traders with different experience levels and budgetary considerations. From the Standard Account to the Platinum and Islamic Accounts, there are options for everyone.

MetaTrader 4 (MT4) Platform: The use of the widely recognized MT4 trading platform offers traders a familiar and feature-rich environment for effective market analysis and execution of trading strategies.

Competitive Spreads: EuroPrime offers competitive spreads across its account types, making it appealing to traders seeking cost-effective trading options.

Educational Resources: The platform provides an extensive range of educational resources, including articles, video tutorials, webinars, e-books, and a glossary, supporting traders in improving their trading knowledge and skills.

Cons:

Regulatory Concerns: EuroPrime's regulatory status is problematic as it is categorized as a “Suspicious Clone” and operates without proper authorization, raising concerns about oversight and compliance.

Lack of Transparency: The platform lacks transparency regarding the effective date, expiry date, and license sharing policy, making it challenging for traders to assess the legitimacy of its operations.

High Minimum Deposit: The Islamic Account requires a minimum deposit of $20,000, which may be prohibitive for many traders. Other account types also have relatively high minimum deposit requirements.

Limited Payment Methods: EuroPrime supports a limited range of payment methods, primarily credit and debit cards, potentially limiting deposit options for some traders.

Market Instruments

EuroPrime provides a diverse array of trading assets, categorized into leveraged instruments and investment products:

Leveraged Instruments:

CFD Products: EuroPrime offers a variety of Contract for Difference (CFD) products. CFDs allow traders to speculate on the price movements of underlying assets without owning them directly. This includes CFDs on indices, commodities, currencies, and more.

Futures: Traders can engage in futures trading through EuroPrime. Futures contracts involve the obligation to buy or sell an asset at a predetermined price and date. They are commonly used for hedging and speculative purposes.

Commodities: EuroPrime provides access to the commodities market, allowing traders to trade commodities such as gold, silver, oil, and agricultural products. These are essential assets in global markets.

Listed Options: EuroPrime offers listed options trading. Listed options provide traders with the right, but not the obligation, to buy or sell an underlying asset at a specified price before a predetermined expiration date. They are used for various trading strategies.

Investment Products:

Stocks: Traders can invest in a wide range of stocks from various markets. Stock trading involves owning shares in publicly traded companies and participating in their performance and potential dividends.

Bonds: EuroPrime offers access to the bond market, allowing investors to buy and trade bonds issued by governments and corporations. Bonds are fixed-income securities that pay periodic interest.

ETFs (Exchange-Traded Funds): ETFs represent a diversified portfolio of assets and are traded on exchanges like stocks. They offer exposure to various sectors and asset classes, providing diversification benefits.

Mutual Funds: EuroPrime provides access to mutual funds, which pool money from multiple investors to invest in a diversified portfolio of stocks, bonds, or other securities. Mutual funds are managed by professional fund managers.

Managed Portfolios: Investors can opt for managed portfolios, where their investments are actively managed by professional portfolio managers. These portfolios are designed to align with specific investment goals and risk tolerances.

EuroPrime's comprehensive range of trading assets offers traders and investors the flexibility to diversify their portfolios and engage in various financial markets, catering to different trading and investment strategies.

Account Types

EuroPrime offers a range of account types designed to cater to various trader preferences and experience levels.

Standard Account: This account type requires a minimum deposit of $250 and offers a maximum leverage of 1:400. The spreads start from 2.5 pips. Traders using the Standard Account have access to the MT4 trading platform and can also utilize a demo account for practice.

Silver Account: With a minimum deposit of $2,000, the Silver Account provides traders with a maximum leverage of 1:400 and tighter spreads, starting from 2.0 pips. It includes access to the MT4 platform and a demo account for skill development.

Gold Account: For a minimum deposit of $5,000, the Gold Account offers enhanced trading conditions with a maximum leverage of 1:400 and spreads starting from 1.5 pips. Traders can use the MT4 platform and access a demo account.

Platinum Account: Designed for experienced traders, the Platinum Account necessitates a minimum deposit of $10,000. It features a maximum leverage of 1:400 and highly competitive spreads, starting from 1.0 pip. Traders can employ the MT4 platform and take advantage of a demo account.

Islamic Account: With a higher minimum deposit requirement of $20,000, the Islamic Account offers a maximum leverage of 1:400 and spreads starting from 1.0 pip. It provides access to the MT4 platform and a demo account while adhering to Islamic finance principles.

| Account Type | Standard | Silver | Gold | Platinum | Islamic |

| Minimum Deposit | $250 | $2,000 | $5,000 | $10,000 | $20,000 |

| Maximum Leverage | 1:400 | 1:400 | 1:400 | 1:400 | 1:400 |

| Spread (From) | 2.5 pips | 2.0 pips | 1.5 pips | 1.0 pips | 1.0 pips |

| Trading tools | MT4 | MT4 | MT4 | MT4 | MT4 |

| Demo account | Yes | Yes | Yes | Yes | Yes |

How to Open an Account?

Here are the steps to open an account with EuroPrime, broken down into six clear points:

Visit EuroPrime's Website: Start by accessing EuroPrime's official website(https://www.europrime.com/) using a web browser.

Locate the “Open an Account” Option: Once on the website's homepage, look for the “Open an Account” or a similar option. This is typically prominently displayed and often found in the top menu or on the homepage.

Select Your Account Type: Choose the type of trading account that best suits your needs and trading style. EuroPrime offers various account types, each with its own features and minimum deposit requirements.

Complete the Registration Form: Fill out the registration form with accurate and required information. You'll typically be asked for personal details, including your name, contact information, and sometimes identity verification documents, as per regulatory requirements.

Fund Your Account: After your registration is successfully completed, you'll need to deposit funds into your trading account. EuroPrime specifies the minimum deposit amount for each account type.

Start Trading: Once your account is funded, you can start trading. Download the trading platform if necessary, log in with your account credentials, and begin executing trades, managing your portfolio, and accessing trading resources.

Leverage

EuroPrime offers a maximum leverage of 1:400 across all its account types, including Standard, Silver, Gold, Platinum, and Islamic accounts. This leverage level provides traders with the potential to amplify their trading positions and potential profits, but it's essential to manage risk carefully when using high leverage in trading.

| Account Type | Standard | Silver | Gold | Platinum | Islamic |

| Maximum Leverage | 1:400 | 1:400 | 1:400 | 1:400 | 1:400 |

Spreads & Commissions

EuroPrime offers competitive spreads for its account types. The spreads start from 2.5 pips for the Standard Account, 2.0 pips for the Silver Account, 1.5 pips for the Gold Account, and as low as 1.0 pip for both the Platinum and Islamic Accounts. These varying spreads cater to different trading preferences, with tighter spreads available for higher-tier accounts.

| Account Type | Standard | Silver | Gold | Platinum | Islamic |

| Spread (From) | 2.5 pips | 2.0 pips | 1.5 pips | 1.0 pips | 1.0 pips |

Trading Platform

EuroPrime provides traders with the widely recognized MetaTrader 4 (MT4) trading platform, a popular choice among traders and brokers worldwide. MT4 is renowned for its comprehensive set of features that cater to various trading needs.

Key Features of EuroPrime's MT4 Trading Platform:

Multiple Time Frames: MT4 allows traders to analyze price movements across multiple timeframes, providing valuable insights into short-term and long-term market trends. This feature is essential for traders employing various trading strategies.

Built-in Indicators: The platform offers a wide range of built-in technical indicators, empowering traders with tools to perform in-depth technical analysis. These indicators assist in making informed trading decisions based on historical price data.

Quotation Analysis Tools: MT4 equips traders with quotation analysis tools, enabling them to assess real-time market data effectively. This feature aids in monitoring price changes and identifying potential entry and exit points.

Automated Trading: MT4 supports automated trading through the use of Expert Advisors (EAs) and custom scripts. Traders can create, backtest, and deploy automated trading strategies, allowing for precise and efficient trade execution.

Traders can benefit from a user-friendly interface and a comprehensive set of tools for effective market analysis and execution of trading strategies.

Deposit & Withdrawal

EuroPrime offers a variety of payment methods for depositing funds into trading accounts. Traders can choose from options like Visa, MasterCard, Visa Debit, Visa Electron, and MasterCard Debit. Each account type has its minimum deposit requirement, catering to traders with different budgetary considerations.

For the Standard Account, the minimum deposit is set at $250. For the Silver Account, it requires a higher minimum deposit of $2,000. The Gold Account has a minimum deposit requirement of $5,000, while the Platinum Account necessitates a minimum deposit of $10,000. Lastly, the Islamic Account has the highest minimum deposit requirement at $20,000.

The processing time for deposits and withdrawals may vary depending on the chosen payment method and the relevant banking institutions' policies. Generally, credit and debit card payments are processed relatively quickly, typically within a few business days.

| Account Type | Standard | Silver | Gold | Platinum | Islamic |

| Minimum Deposit | $250 | $2,000 | $5,000 | $10,000 | $20,000 |

Customer Support

For customer support, EuroPrime offers multiple contact channels to assist traders. You can reach their support team via phone at +35726030155 or send inquiries and requests to support@europrime.com through email. Additionally, for quick access to information and assistance, you can visit their official website at https://www.europrime.com/.

Their responsive customer support team is ready to address your trading inquiries and provide assistance promptly through these contact options.

Educational Resources

EuroPrime offers a rich array of educational resources to support traders in enhancing their knowledge and skills. Some of the specific educational tools provided include:

Educational Articles: EuroPrime offers a collection of informative articles covering various aspects of trading, market analysis, and strategies.

Video Tutorials: Traders can access video tutorials that provide step-by-step guidance on trading techniques, platform navigation, and market analysis.

Webinars: EuroPrime hosts webinars featuring industry experts who share insights on market trends, trading strategies, and risk management.

Ebooks: Traders can access e-books and guides that delve into in-depth topics related to trading and financial markets.

Glossary: A comprehensive glossary of trading terms is available to help traders understand and navigate the trading jargon.

Conclusion

In conclusion, EuroPrime offers traders a diverse array of financial instruments and investment products, allowing for portfolio diversification. However, the concern lies in its regulatory status as a “Suspicious Clone,” operating without clear authorization. While it claims to hold a “Retail Forex License” in Belize, traders should exercise caution due to potential oversight issues.

On the positive side, EuroPrime provides various account types, competitive spreads, and a user-friendly MT4 platform. Its customer support options are extensive, and it offers educational resources to support traders. Still, the lack of regulatory transparency remains a significant drawback, and potential clients should carefully weigh the risks associated with trading on this platform.

FAQs

Q: What is EuroPrime's minimum deposit requirement?

A: EuroPrime offers various account types with minimum deposits ranging from $250 to $20,000.

Q: Is EuroPrime regulated?

A: EuroPrime's regulatory status is categorized as a “Suspicious Clone,” which raises concerns about its regulatory compliance and oversight.

Q: What trading platform does EuroPrime use?

A: EuroPrime utilizes the MetaTrader 4 (MT4) trading platform, known for its advanced features and user-friendly interface.

Q: What leverage is available at EuroPrime?

A: EuroPrime offers a maximum leverage of 1:400 across all its account types.

Q: How can I contact EuroPrime's customer support?

A: You can reach EuroPrime's customer support via phone at +35726030155, email at support@europrime.com, or through their official website at https://www.europrime.com/.

Q: Does EuroPrime offer educational resources?

A: Yes, EuroPrime provides a range of educational materials, including articles, video tutorials, webinars, e-books, and a glossary to support traders in enhancing their knowledge and skills.

Review 2

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now