Score

HuiYing

China|5-10 years|

China|5-10 years| http://www.huiyinghuanqiu.com/

Website

Rating Index

Contact

Licenses

No valid regulatory information, please be aware of the risk!

Single Core

1G

40G

Contact number

Other ways of contact

Broker Information

More

汇赢环球

HuiYing

China

Pyramid scheme complaint

Expose

Check whenever you want

Download App for complete information

- It has been verified that this broker currently has no valid regulation. Please be aware of the risk!

WikiFX Verification

Users who viewed HuiYing also viewed..

XM

Neex

FXCM

MiTRADE

HuiYing · Company Summary

| Aspect | Information |

| Registered Country/Area | China |

| Company Name | HuiYing |

| Regulation | Unregulated |

| Minimum Deposit | $100 (Basic Account) |

| Maximum Leverage | Up to 1:1000 |

| Spreads | Varies by account type, ranging from 0.3 pips to 2 pips |

| Trading Platforms | Questionable web-based platform (not recommended) |

| Tradable Assets | Forex, Stocks, Indices, Commodities, Cryptocurrencies |

| Account Types | Basic, Standard, Advanced, Professional, Elite |

| Customer Support | Slow and unhelpful |

| Payment Methods | Bank Wire, PayPal, Skrill, Neteller, Cryptocurrency (fees may apply) |

| Educational Tools | Lacking comprehensive educational resources |

Overview

HuiYing, operating in an unregulated and questionable environment, stands as a concerning choice for traders. With no regulatory oversight, a dubious trading platform, and subpar customer support, the lack of transparency and accountability raises significant red flags. The absence of comprehensive educational resources further compounds the disadvantages, leaving traders ill-equipped to navigate the intricate world of trading. HuiYing's reputation is far from stellar, with allegations of being a 'scam' casting a dark shadow over its credibility. Engaging with this broker appears to be a risky endeavor, one that prudent investors should steer clear of.

Regulation

HuiYing operates in an unregulated environment without oversight from established financial regulators. This lack of supervision raises concerns, as unregulated firms like HuiYing aren't subject to strict rules and standards that regulated entities must follow. This absence of oversight heightens the risk of fraud, financial mismanagement, and unethical conduct. Customers dealing with unregulated brokers have limited recourse in case of disputes, underscoring the importance of choosing regulated and reputable alternatives for financial transactions and investments.

Pros and Cons

| Pros | Cons |

|

|

|

|

|

|

|

|

|

HuiYing offers a variety of trading instruments, catering to different investment preferences. However, its operation in an unregulated environment raises concerns about reliability and oversight. The trading platform's trustworthiness and charting data are questionable. Customer support is slow and unhelpful, while educational resources are lacking. Additionally, the broker's reputation has been marred by allegations of being a 'scam.' Engaging with HuiYing appears risky and unsatisfactory for traders.

Market Instruments

HuiYing provides a diverse range of trading instruments to cater to various investment preferences and strategies. These instruments fall into several categories:

FOREX (Foreign Exchange): HuiYing offers a comprehensive selection of currency pairs for trading in the Forex market. This allows investors to speculate on the relative strength of one currency against another, accommodating both short-term and long-term trading strategies.

STOCKS: Investors can trade shares of publicly listed companies using this instrument. This enables them to participate in the performance and potential profits of these companies.

INDICES: HuiYing also allows trading in stock indices such as the S&P 500 and NASDAQ. This permits investors to speculate on the overall performance of a group of stocks rather than individual companies.

COMMODITIES: Commodities like gold, oil, and wheat are available for trading in various forms, such as spot contracts or futures. These commodities serve as a hedge against inflation or geopolitical events.

CRYPTOCURRENCIES: HuiYing offers access to the cryptocurrency market, featuring digital currencies like Bitcoin, Ethereum, and Ripple. These cryptocurrencies are known for their volatility and potential for significant returns.

Account Types

HuiYing offers a variety of trading account types, each designed to suit the specific needs and preferences of traders at different skill levels. These accounts are structured into five tiers:

Basic Account: Geared towards beginners, with a minimum deposit of $100. It offers competitive spreads and a leverage ratio of 1:200.

Standard Account: Suitable for traders with some experience, requiring a minimum deposit of $1,000. It features tighter spreads and a leverage of 1:300.

Advanced Account: Designed for intermediate to advanced traders, with a minimum deposit of $5,000. This account offers exceptionally tight spreads and a leverage ratio of 1:500.

Professional Account: Ideal for experienced traders, requiring a minimum deposit of $15,000. It provides access to incredibly tight spreads and a substantial leverage ratio of 1:1000.

Elite Account: Tailored for seasoned professionals and high-net-worth individuals, with a minimum deposit of $30,000. This account offers the lowest spreads and the highest leverage.

Leverage

HuiYing provides different levels of leverage based on the selected trading account type, with the highest leverage going up to 1:1000. Leverage enables traders to manage larger positions with less capital, amplifying both potential gains and losses. It's crucial for traders to exercise prudence when utilizing leverage, taking into account their risk tolerance, trading approach, and risk management strategies.

Spreads and Commissions

Spread:

The spread, or the difference between the buying and selling prices, varies depending on the selected account type. For the “Basic Account,” spreads start from 2 pips. Moving up the tier, the “Standard Account” requires a minimum deposit of $1,000 and offers spreads beginning at 1.5 pips. The “Advanced Account,” designed for traders with a minimum deposit of $5,000, provides even tighter spreads, starting at just 1 pip. For those opting for the “Professional Account,” which is ideal for traders with a $15,000 minimum deposit, ultra-tight spreads commence at 0.5 pips. Finally, the “Elite Account,” tailored for high-net-worth individuals and professionals with a $30,000 minimum deposit, boasts the tightest spreads at 0.3 pips.

Commissions:

While the spread details are clear for each account type, commission specifics are not explicitly outlined in the provided information. It's crucial for traders to inquire about commissions with HuiYing and potentially consider whether they may adjust based on trading behavior. Understanding both the spread and commission structures is essential for traders to make informed decisions based on their trading preferences and strategies.

Deposit & Withdrawal

Deposit Options:

When it comes to depositing funds into your trading account, HuiYing provides several choices. First, there's the traditional “Bank Wire” option, which takes 2-5 business days to process. However, it's important to note that this method may come with a deposit fee of $25 or more.

For those seeking quicker deposit processing, HuiYing offers digital payment solutions. “PayPal” is an option, which typically processes within approximately 1 hour but does incur a 2% fee. Similarly, “Skrill” and “Neteller” also provide swift processing times of around 1 hour, but they too carry a 2% fee.

Additionally, HuiYing supports cryptocurrency deposits, offering flexibility for those engaged in digital assets. However, it's worth noting that the fees for cryptocurrency deposits can vary depending on the specific cryptocurrency used.

Withdrawal Options:

When it comes to withdrawals, HuiYing offers several methods as well. “Bank Wire” is available and takes 2-5 business days to process, but the withdrawal fee is unspecified, so it's important to inquire about this aspect.

For those preferring digital wallet withdrawals, HuiYing provides options like “PayPal,” “Skrill,” and “Neteller.” These methods generally process within 24 hours, but the withdrawal fees are not explicitly mentioned in the provided information.

Lastly, cryptocurrency withdrawals are also supported by HuiYing, typically taking 24 hours to complete. However, the withdrawal fees for cryptocurrency can vary depending on the specific digital currency used.

Traders should take careful consideration of these options, assessing associated fees and processing times, when selecting their preferred deposit and withdrawal methods to align with their individual trading needs and preferences.

Trading Platforms

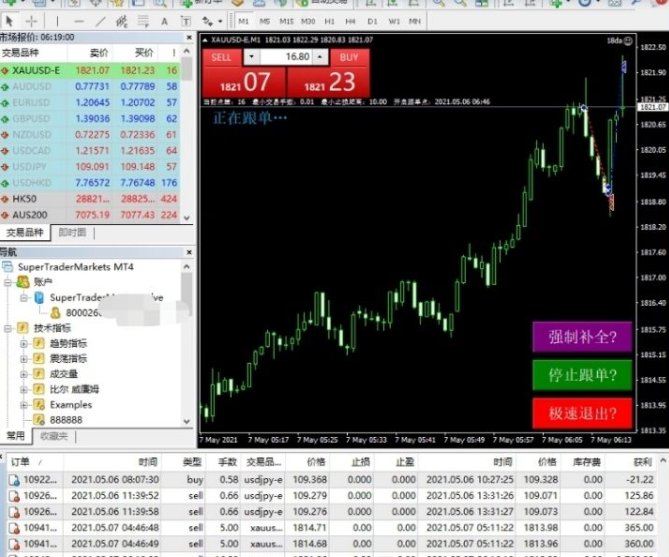

The reliability and accuracy of HuiYing's web-based trading platform have come under scrutiny. There are concerns about the platform's trustworthiness, with trading activities that seem misleading and potentially jeopardize traders' investments. Furthermore, the charting data provided on this platform is questionable and does not accurately represent real market conditions. For a more trustworthy and reputable trading experience, it is recommended to consider industry-standard solutions like the MetaTrader platforms, which are renowned for their advanced charting tools and robust features.

Customer Support

Customer support at QQ ID 3416412044 is disappointingly lacking. The response time to queries and concerns is unacceptably slow, leaving customers frustrated and in the dark for extended periods. Additionally, the quality of assistance provided is subpar, with representatives often failing to address the root of the issues or offering vague and unhelpful responses. Overall, the customer support experience is unsatisfactory, and clients may find it challenging to get the assistance they need in a timely and effective manner.

Educational Resources

HuiYing's educational resources are noticeably deficient. Unlike numerous reputable brokers that offer extensive educational materials to empower traders, HuiYing fails to meet this standard. The absence of such resources leaves traders on this platform at a disadvantage, particularly if they seek to improve their trading skills or gain deeper insights into the financial markets. This educational gap could hinder traders' capacity to make well-informed decisions and effectively navigate the intricate landscape of trading.

Summary

In summary, HuiYing operates without regulatory oversight, raising concerns about its reliability. The trading platform's trustworthiness is questionable, and the absence of educational resources puts traders at a disadvantage. Customer support is notably lacking, leaving clients frustrated. Adding to these concerns, the label of 'scam' associated with their website further erodes trust in their services. Engaging with HuiYing appears to be a risky and unsatisfactory choice for traders.

FAQs

Q1: Is HuiYing a regulated broker?

A1: No, HuiYing operates in an unregulated environment without oversight from established financial regulators.

Q2: What are the available trading instruments on HuiYing?

A2: HuiYing offers a range of instruments, including Forex, stocks, indices, commodities, and cryptocurrencies.

Q3: What is the minimum deposit required for the Basic Account?

A3: The Basic Account on HuiYing requires a minimum deposit of $100.

Q4: Does HuiYing provide educational resources for traders?

A4: Unfortunately, HuiYing lacks comprehensive educational materials, which could be a disadvantage for traders.

Q5: How long does it take for cryptocurrency withdrawals on HuiYing?

A5: Cryptocurrency withdrawals on HuiYing typically take 24 hours to process, but fees may vary depending on the specific cryptocurrency used.

Review 1

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now