Score

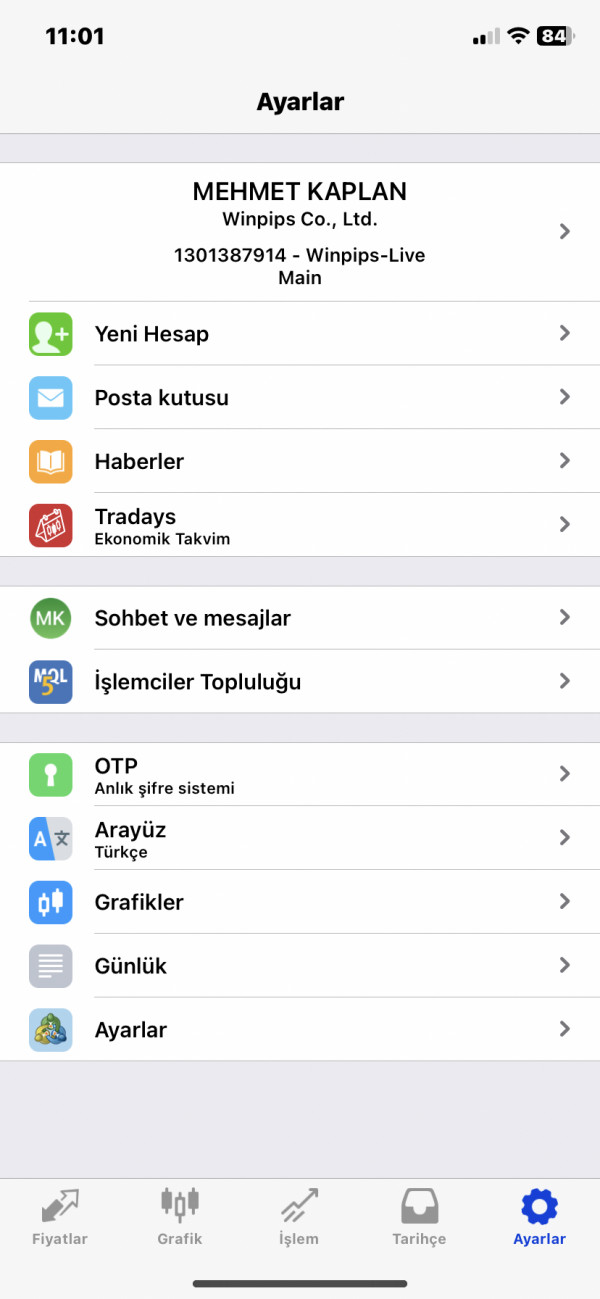

Winpips

Cambodia|2-5 years|

Cambodia|2-5 years| https://winpips.com.kh/

Website

Rating Index

Contact

Licenses

No valid regulatory information, please be aware of the risk!

Single Core

1G

40G

Contact number

+855 888848390

Other ways of contact

Broker Information

More

Winpips

Winpips

Cambodia

Pyramid scheme complaint

Expose

Check whenever you want

Download App for complete information

- It has been verified that this broker currently has no valid regulation. Please be aware of the risk!

WikiFX Verification

Users who viewed Winpips also viewed..

FP Markets

CPT Markets

GO MARKETS

FBS

Winpips · Company Summary

| Aspect | Information |

| Registered Country/Area | Cambodia |

| Founded Year | 1-2 years ago |

| Company Name | Winpips |

| Regulation | Lacks valid regulation |

| Minimum Deposit | $50 (Crypto account) |

| Maximum Leverage | Up to 1:500 (varies by account type) |

| Spreads | Starting from 0.1 pips (varies by account type) |

| Trading Platforms | Webtrader, MT4 |

| Tradable Assets | Forex pairs, indices, commodities, stocks, cryptocurrencies |

| Account Types | Classic (Micro, Standard, Premium), VIP (Executive, Elite, Supreme), Crypto |

| Demo Account | Not mentioned |

| Islamic Account | Not mentioned |

| Customer Support | Email: info@winpips.com.kh, Phone: +855 888848390 |

| Payment Methods | Credit/debit cards, bank transfers, e-wallets, cryptocurrency |

Overview of Winpips

Winpips is an unregulated brokerage firm operating in Cambodia for 1-2 years, and it lacks valid regulation, which poses potential risks for investors. The broker offers a variety of trading instruments, including CFDs on Forex pairs, indices, commodities, and stocks. There are classic and VIP account options, each with varying minimum deposit requirements, leverage ratios up to 1:500, and spreads starting from 0.1 pips. Additionally, Winpips provides a Crypto account for those interested in cryptocurrency trading.

While Winpips offers high leverage and spreads on certain account types, it's crucial to note that the broker has faced concerns raised in exposure reports on WikiFX. Users have reported difficulties in withdrawing funds, alleging additional fees and communication issues with the company. As a result, investors should exercise caution and carefully evaluate the associated risks when considering financial transactions with Winpips.

Pros and Cons

Winpips, as a trading platform, presents several advantages and disadvantages. It offers a diverse range of market instruments and provides high leverage options, allowing traders to access a wide variety of trading opportunities. Moreover, spreads starting from 0.1 pips enhance the trading experience. The platform also supports multiple deposit and withdrawal methods. On the downside, Winpips lacks valid regulation, which raises concerns about its reliability. Additionally, exposure reports highlight difficulties in fund accessibility, and some account types require high minimum deposits. While the platform offers various account types with different features and provides customer support through email and phone, there have been reports of challenges in withdrawing funds and communication issues with users. Lastly, it's worth noting that the main website is currently unavailable, which can be an inconvenience for potential users.

| Pros | Cons |

|

|

|

|

|

|

|

|

|

|

|

|

Is Winpips Legit?

This broker, Winpips, lacks valid regulation, posing potential risks for investors. It is crucial to exercise caution when considering any financial transactions with this entity.

Market Instruments

CFDs:

Winpips offers a range of CFDs, including Forex pairs like EUR/USD, USD/JPY, GBP/USD, AUD/USD, CAD/USD, NZD/USD; indices such as S&P 500, NASDAQ 100, FTSE 100, DAX 30, CAC 40, Nikkei 225; commodities like Gold, Silver, Oil, Natural Gas, Coffee, Sugar; and stocks like Apple, Microsoft, Amazon, Tesla, Alphabet, and Meta.

FOREX:

The Forex market instruments at Winpips encompass major pairs like EUR/USD, USD/JPY, GBP/USD, AUD/USD, CAD/USD, NZD/USD; minor pairs such as EUR/GBP, USD/CHF, EUR/CAD, AUD/NZD, USD/CAD; and exotic pairs including TRY/JPY, RUB/USD, MXN/USD, BRL/USD, and CNY/JPY.

INDICES:

In terms of indices, Winpips provides access to S&P 500 (US stock market index), NASDAQ 100 (US technology stock index), FTSE 100 (UK stock market index), DAX 30 (German stock market index), CAC 40 (French stock market index), and Nikkei 225 (Japanese stock market index).

COMMODITIES:

Winpips allows trading in various commodities, including Gold and Silver (precious metals), Oil and Natural Gas (energy commodities), and agricultural commodities like Coffee and Sugar.

STOCKS:

The platform also features stocks of prominent companies such as Apple (US technology company), Microsoft (US software company), Amazon (US e-commerce company), Tesla (US electric vehicle company), Alphabet (US technology company), and Meta (US social media company).

Pros and Cons

| Pros | Cons |

| Diverse range of market instruments | Lack of valid regulation |

| Access to major, minor, and exotic Forex pairs, a variety of indices, commodities, and stocks | Limited information on specific trading conditions |

| Opportunities to trade in various asset classes including precious metals, energy commodities, and agricultural commodities | Potential risks associated with unregulated trading |

Account Types

CLASSIC:

Winpips offers a range of classic account types. The Micro account has a minimum deposit requirement of $100, with leverage up to 1:500 and spreads starting from 1.0 pips. The Standard account necessitates a minimum deposit of $500, provides leverage up to 1:500, and offers spreads from 0.8 pips. For those with a higher capital, the Premium account requires a minimum deposit of $5000, provides leverage up to 1:500, and offers spreads from 0.6 pips.

VIP:

Winpips also provides VIP account options to cater to larger investors. The Executive account demands a minimum deposit of $25,000, offers leverage up to 1:500, and boasts spreads from 0.4 pips. The Elite account, designed for substantial investments, requires a minimum deposit of $100,000, provides leverage up to 1:500, and features spreads from 0.2 pips. The Supreme account, suitable for high-net-worth individuals, necessitates a minimum deposit of $500,000, offers leverage up to 1:500, and boasts spreads from 0.1 pips.

CRYPTO:

For those interested in cryptocurrency trading, Winpips offers a Crypto account. This account type requires a minimum deposit of $50, provides leverage up to 1:50, and offers spreads from 0.5%.

| Pros | Cons |

| Diverse range of account types available | High minimum deposit requirements for some accounts |

| Offers high leverage options | Limited information on additional account features |

| Includes a Crypto account for cryptocurrency trading | Lower leverage for Crypto account compared to others |

Leverage

Winpips provides leverage options that vary depending on the account type. Leverage ratios can go as high as 1:500 for most accounts, allowing traders to control larger positions relative to their capital. However, it's important to note that the leverage level can differ between account types, and traders should carefully consider their risk tolerance and trading strategy when choosing an account with a specific leverage ratio.

Spreads

Winpips offers spreads starting from 0.1 pips on certain account types, with commissions varying based on the specific account and trading conditions.

Minimum Deposit

Winpips features varying minimum deposit requirements for its account types, starting at $50 for the Crypto account, $100 for the Micro account, $500 for the Standard account and Premium account, $25,000 for the Executive account, $100,000 for the Elite account, and $500,000 for the Supreme account.

Deposit & Withdrawal

Winpips offers a variety of deposit and withdrawal methods, including credit/debit cards, bank transfers, e-wallets, and cryptocurrency. Deposits are processed instantly, while withdrawals can take up to 3 business days to be processed. There are no deposit fees, but withdrawal fees vary depending on the method used. For example, withdrawals to credit/debit cards incur a fee of $25.

| Pros | Cons |

| Offers a variety of deposit methods | Withdrawal fees vary depending on the method used |

| Instant processing of deposits | Withdrawals can take up to 3 business days to be processed |

| No deposit fees | Withdrawals to credit/debit cards incur a $25 fee |

Trading Platforms

WEBTRADER: Winpips offers a Webtrader account type that can be accessed on both desktop and mobile devices.

MT4: Winpips provides access to the widely recognized MT4 trading platform. This account type, available as a premium option, offers a variety of features and tools.

Customer Support

Winpips provides customer support through email at info@winpips.com.kh and can be reached via phone at +855 888848390.

Reviews

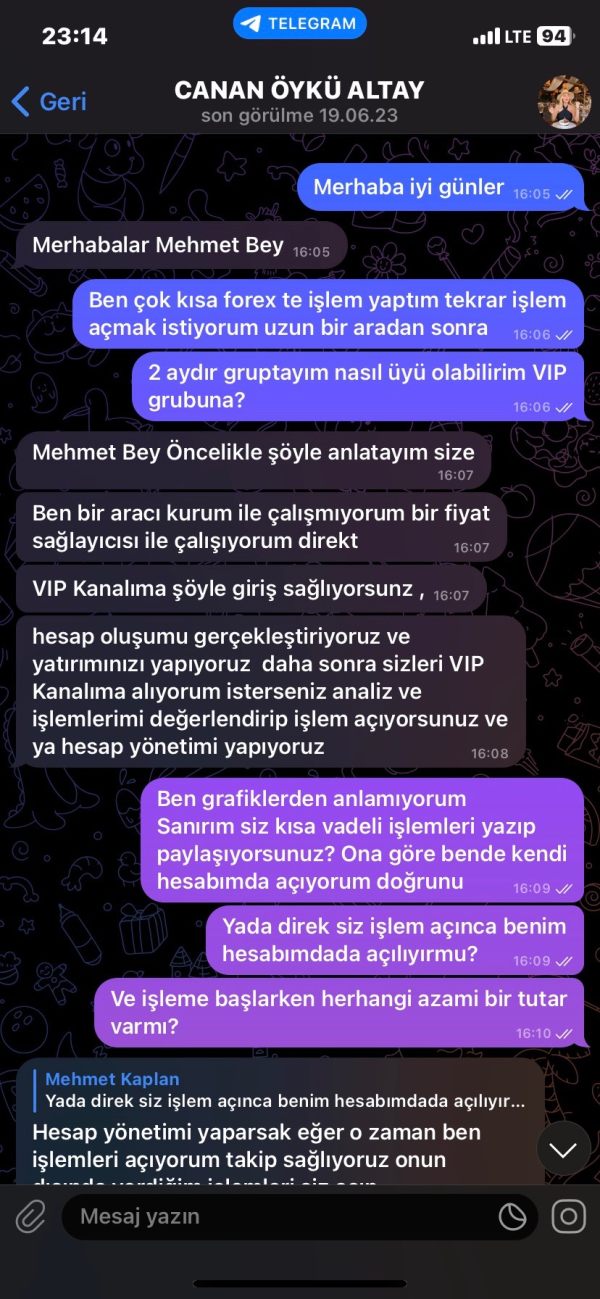

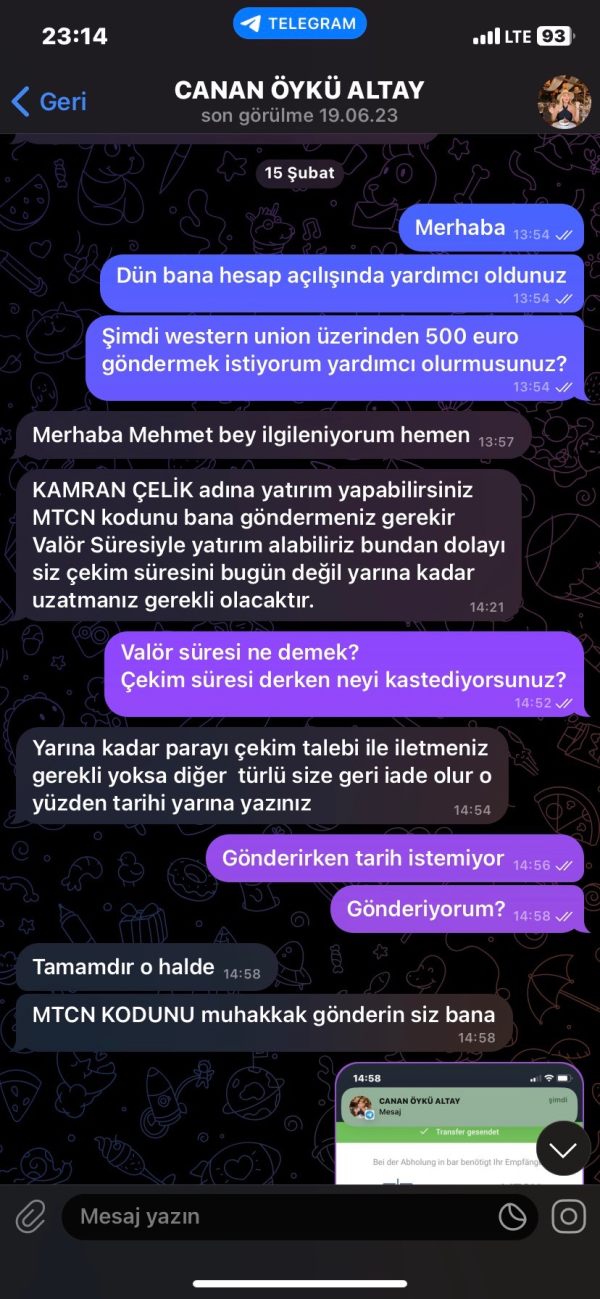

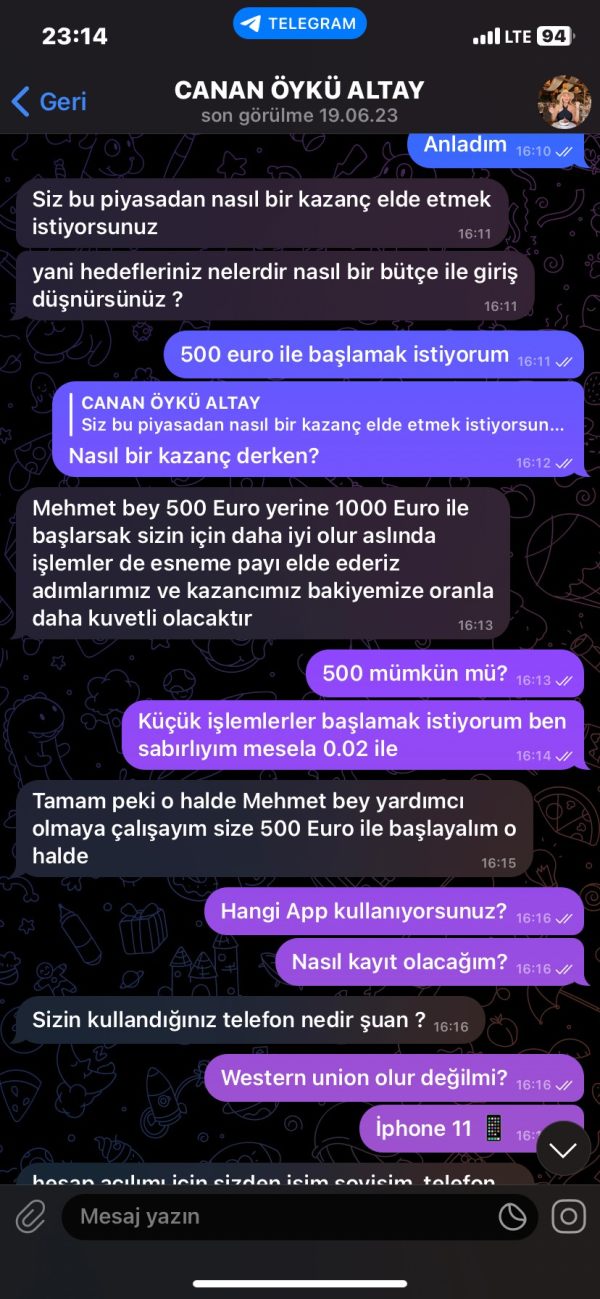

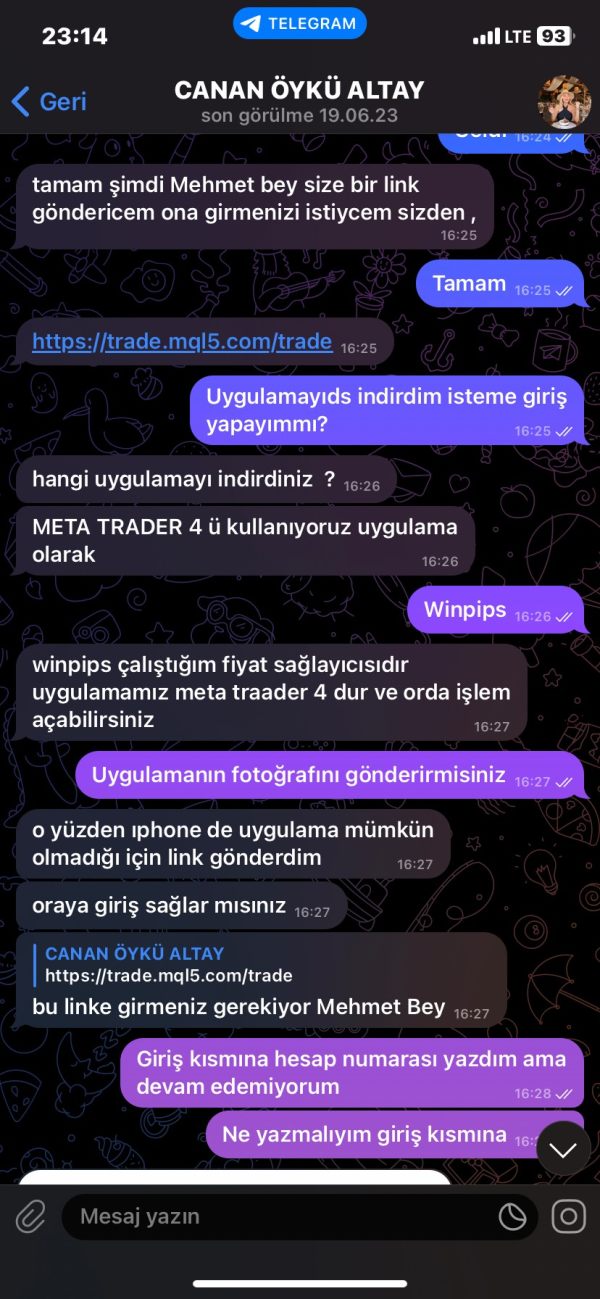

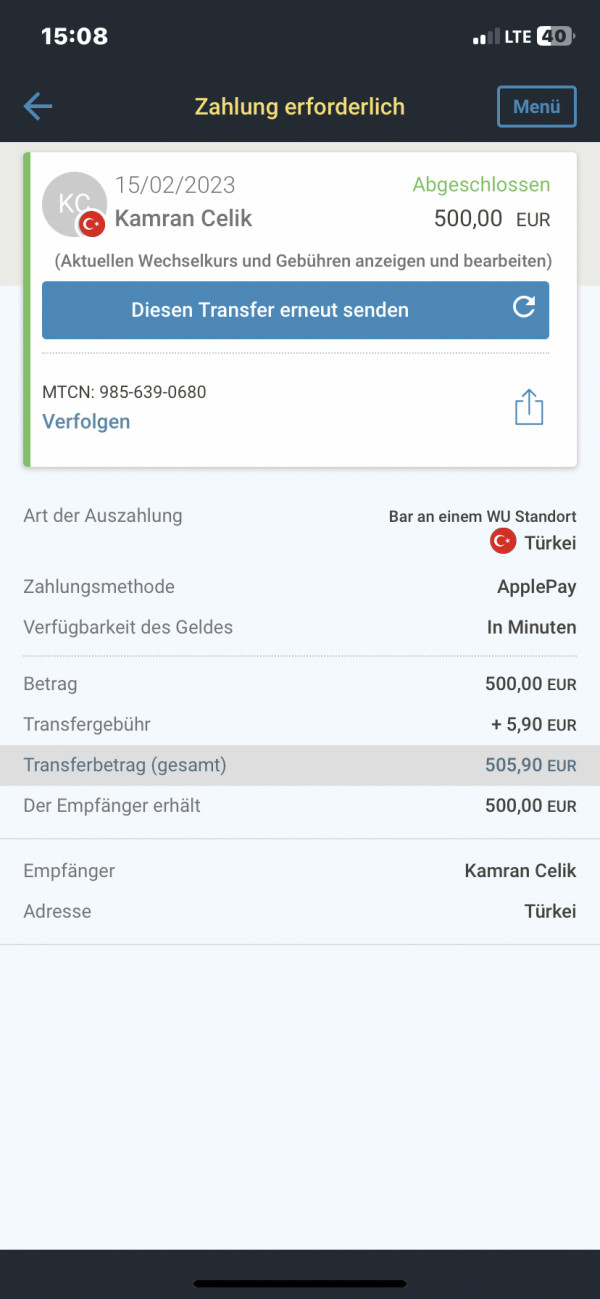

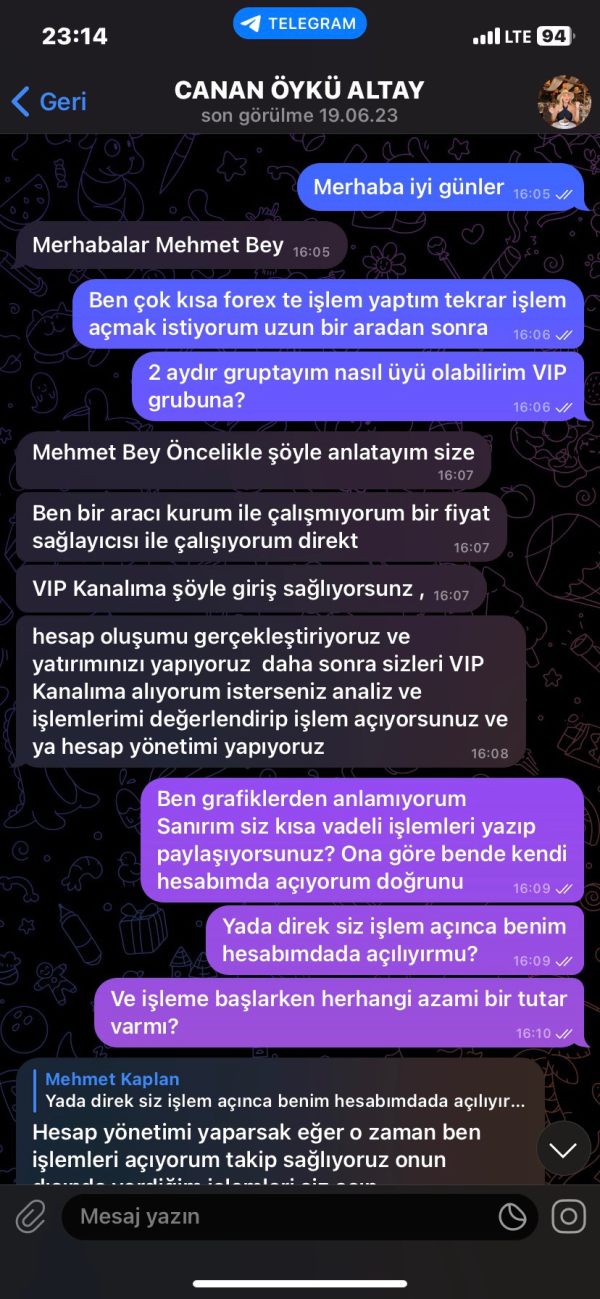

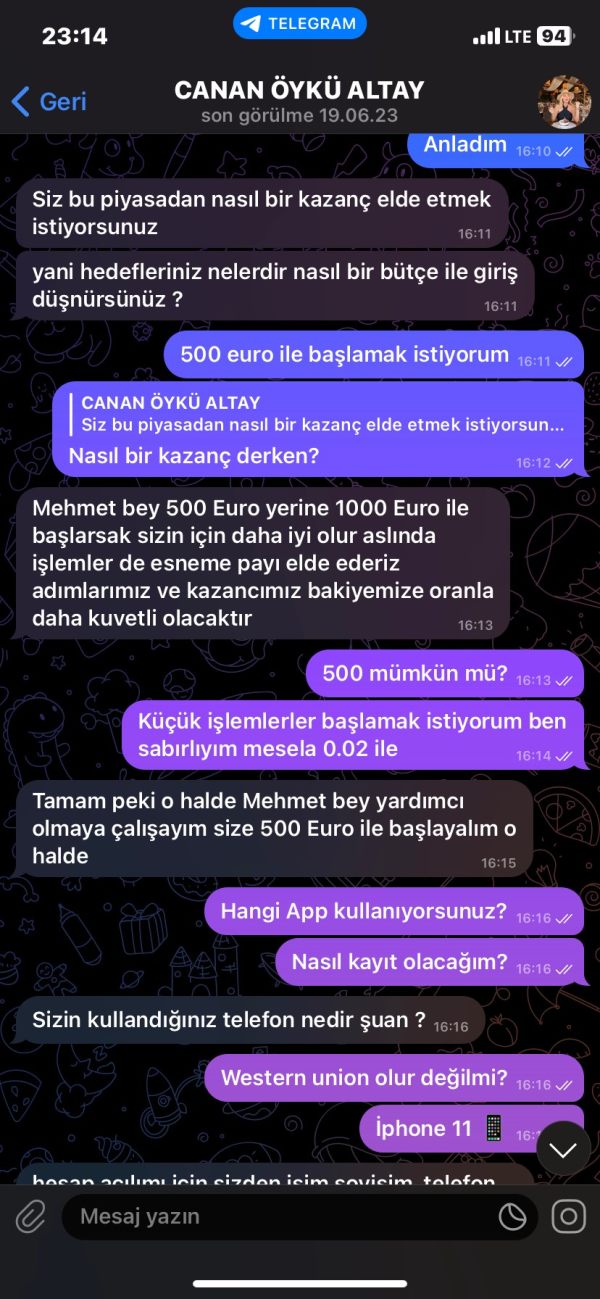

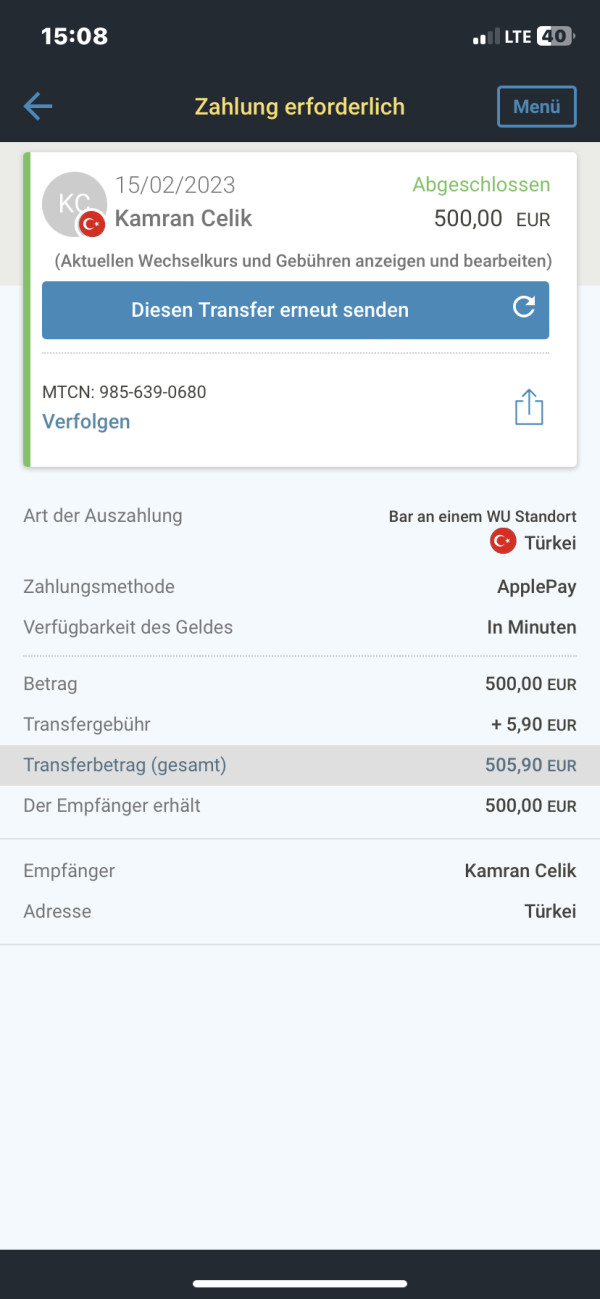

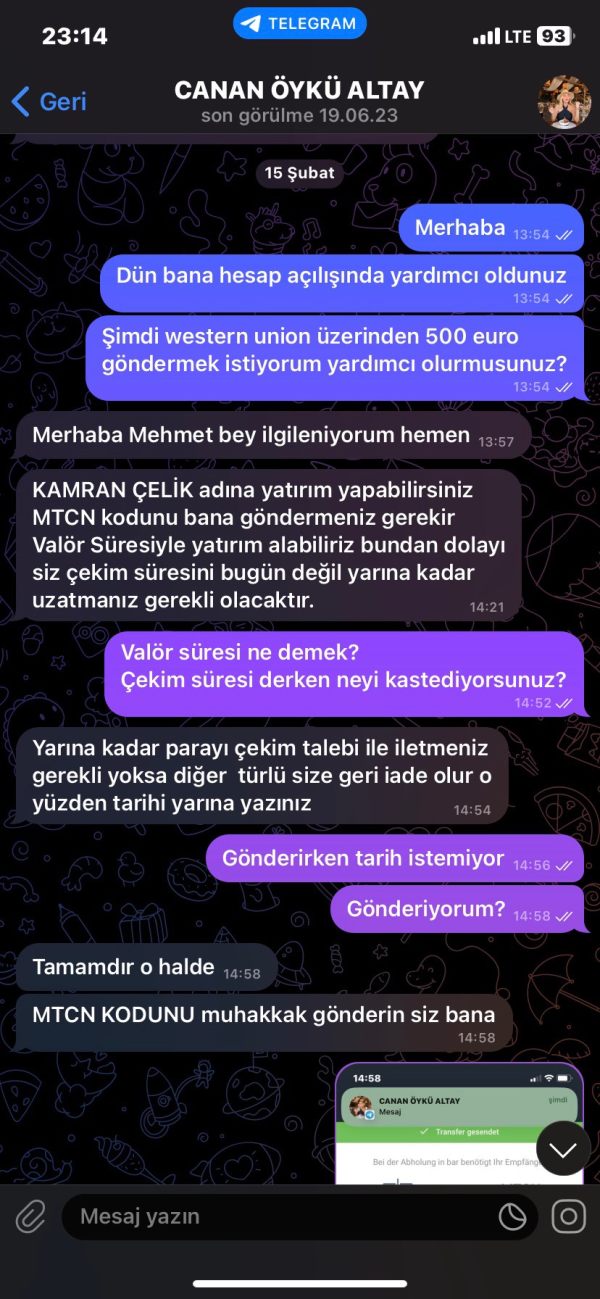

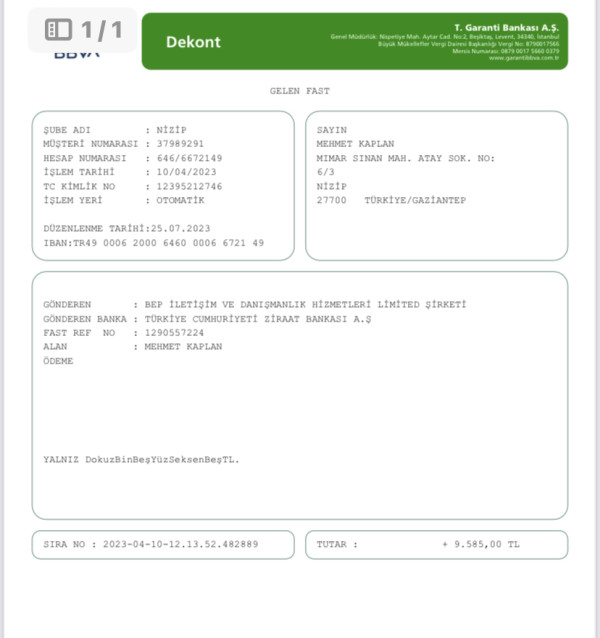

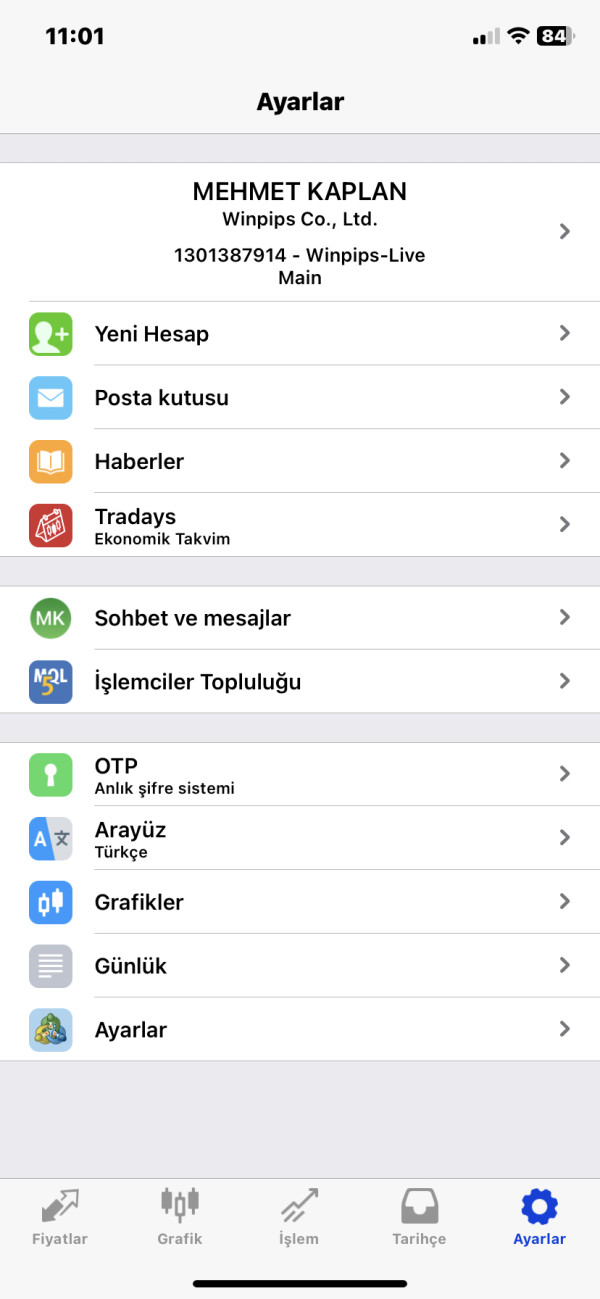

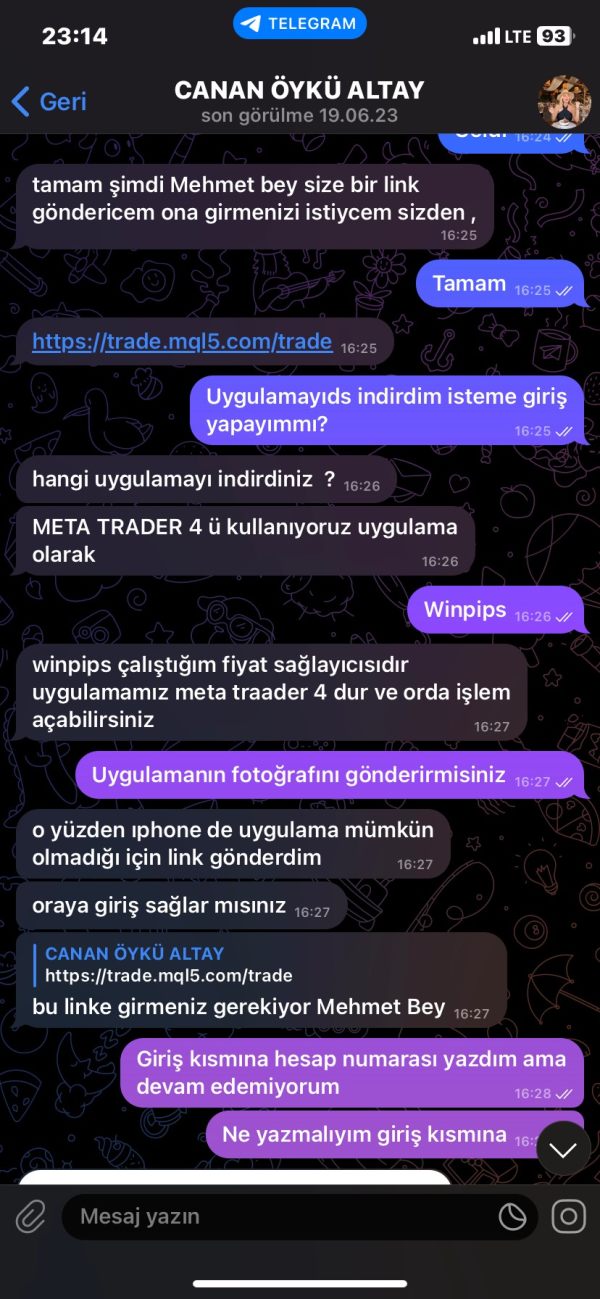

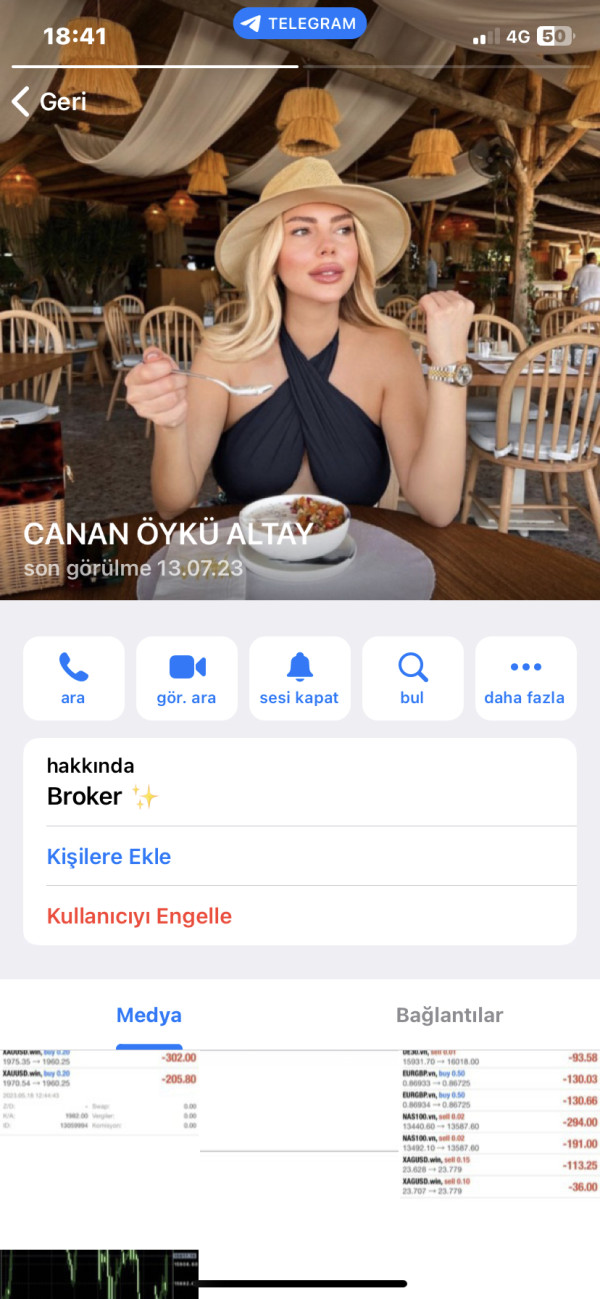

There are two exposure reports on Winpips on WikiFX. Both reports raise concerns about difficulties in withdrawing funds from the platform. One user, Mehmet Kaplan, mentioned depositing $500 and actively trading for several months but faced issues with withdrawal, alleging additional fees and a lack of communication with the company. Another user, Mehmet Kapi, shared a similar experience, stating that despite a $55,000 balance, they encountered withdrawal problems and struggled to reach the company. These reports highlight concerns related to fund accessibility and communication with Winpips.

Conclusion

In conclusion, Winpips presents both advantages and disadvantages for potential investors. On the positive side, the broker offers a variety of market instruments, including CFDs, Forex, indices, commodities, and stocks, providing options for diversification. Additionally, Winpips provides different account types with varying leverage ratios and spreads to accommodate traders with various capital levels and risk tolerances. However, it's important to exercise caution as Winpips lacks valid regulation, which could pose potential risks for investors. Furthermore, there are concerns raised in user reviews regarding difficulties in withdrawing funds from the platform, which may indicate issues related to fund accessibility and communication with the company. Therefore, prospective investors should carefully evaluate their options and consider the associated risks before engaging in financial transactions with Winpips.

FAQs

Q: Is Winpips a regulated broker?

A: Winpips lacks valid regulation, which can pose risks for investors. Exercise caution when dealing with this broker.

Q: What financial instruments can I trade on Winpips?

A: Winpips offers a variety of instruments, including CFDs (Forex, indices, commodities, stocks) and Forex pairs (major, minor, exotic).

Q: What are the different account types on Winpips?

A: Winpips provides Classic, VIP, and Crypto account types with varying deposit requirements, leverage, and spreads.

Q: What leverage options does Winpips offer?

A: Winpips offers leverage up to 1:500 on most account types, but it may vary depending on the account you choose.

Q: How can I contact Winpips customer support?

A: You can reach Winpips customer support via email at info@winpips.com.kh or by phone at +855 888848390.

Review 2

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now